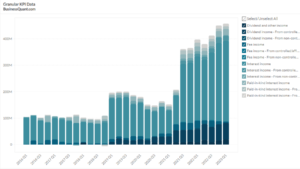

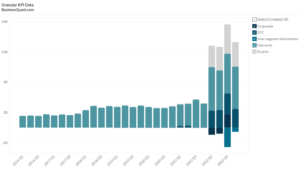

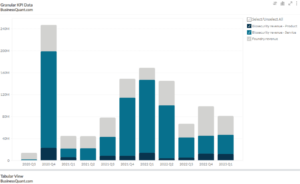

Semiconductor Consumption By Region (2003 – 2016)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights semiconductor consumption by region.

This article discusses the statistics on Semiconductor Consumption by Country 2020. In 2016, the demand for the Internet of Things led to a US $12 billion increase in global consumption of semiconductors to US $365.6 billion. As semiconductors are embedded in almost every technologically driven device, the global demand for the same reached an all-new high in 2018 requiring shipment of over 1 trillion units of semiconductors for the first time in history. As per Semiconductor Industry Association (SIA) president and CEO, John Neuffer,” Market growth slowed during the second half of 2018, but the long-term outlook remains strong. Semiconductors continue to make the world around us smarter and more connected, and a range of budding technologies – artificial intelligence, virtual reality, the Internet of Things, among many others – hold tremendous promise for future growth.

Semiconductor Consumption by Country: Figures in US $ bn

| Country | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| China | 103.65 | 101.22 | 132.06 | 151.16 | 164.33 | 180.76 | 201.27 | 206.86 | 213.88 |

| Americas | 44.35 | 36.18 | 49.09 | 45.22 | 38.81 | 38.36 | 41.25 | 42.43 | 29.25 |

| Europe | 34.64 | 26.96 | 36.10 | 41.99 | 34.74 | 31.53 | 33.43 | 21.22 | 14.62 |

| Japan | 31.49 | 25.31 | 35.15 | 27.13 | 22.85 | 21.78 | 20.98 | 19.45 | 14.99 |

| Rest of world | 48.28 | 46.83 | 64.29 | 57.49 | 52.27 | 52.67 | 58.67 | 63.65 | 92.86 |

| Worldwide consumption | 262.40 | 236.50 | 316.70 | 323.00 | 313.00 | 325.10 | 355.60 | 353.60 | 365.60 |

(Source: Business Quant)

China continues to be the largest consumer, having imported the US $312 billion worth of semiconductors in 2018, accounting for 58.3% share in worldwide consumption. The country’s top 4 smartphone providers namely, Lenovo, Xiaomi, BBK and Huawei were the top semiconductor buyers in 2018, with a collective purchase of US $60 billion.China has been allocating funds to develop its semiconductor industry since the 1980s. The launch of Made in China 2025 has resulted in quantifying targets to be achieved in 2020, 2025 and 2030. For example, by 2025 it is expected to locally manufacture 75% of back-end equipment and 30% of front-end equipment with annual industry revenue growth of 20%.

In the Americas region, United States is the largest consumer with the majority share of the total semiconductor sales taken up by manufacturers in the Information and Communications Technology (ICT) sector, followed by the automotive manufacturers. In spite of the shifting of global consumption heavily towards Asia, the U.S. semiconductor industry continues to offer stiff competition by offshoring production process to Asian countries and focusing on design and marketing in-house.

Europe’s share in the semiconductor consumption market declined to single digits in 2013 with the US $ 31.53 billion in consumption. Its lowest sales was in 2016 when it consumed only US $ 14.6 billion worth in chips. The semiconductor growth could be driven in a positive direction by Germany, which happens to be a key market in Europe. The country is the largest electronics manufacturer in the continent and also happens to be a member of the World Trade Organization which permits it to import non-tariff semiconductor manufacturing equipment (SME) from the United States. Apart from acquisitions such as that of American multinational Freescale by Dutch NXP Semiconductors, no new large semiconductor plants have been set up in Europe in the past few decades. Things changed in 2018 when Bosch announced its decision to invest US $1.1 billion in a semiconductor fabrication plant at Dresden, Germany which is scheduled to commence operations in 2021.

During 2008, Japan’s chips consumption fell by the US $ 17.465 billion from 2007. For the next few years until 2015, Japan’s share in the global consumption of semiconductors lagged behind Europe. Nonetheless, the country’s appetite for American semiconductors remained consistent. As per SIA estimates, the US $ 14.6 billion worth chips were shipped by the United States to Japan in 2017. The Japanese semiconductor market grew to US $ 40 billion in 2018 from a US $ 36.6 billion markets in the previous year. This growth provides a lot of opportunities for an influx of American chips

Amongst the Rest of the World region, Singapore accounts for 11% of the global semiconductors’ market share and is home to more than 60 semiconductor suppliers. 7% of the country’s GDP can be credited to the chips industry. India’s demand for semiconductors is increasing by the hundreds amidst the rapid growth of the electronics system design manufacturing (ESDM) industry. By 2020, the semiconductor industry in India is expected to grow to the US $ 52.58 billion from the US $ 10.02 billion in 2013. Taiwan has a bright future in the 5G space. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest semiconductor foundry has been gearing up to boost production to meet demands for the latest 5G wireless devices. The country might also benefit from the U.S.-China trade dispute as Chinese companies have been forced to look elsewhere for chips manufacturing.

Access thousands of more such datasets by Registering for Free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.