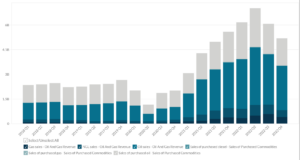

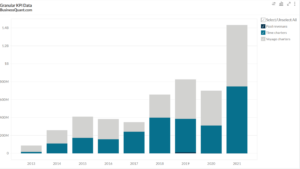

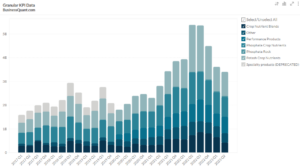

Plug Power’s Revenue Breakdown (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights Plug Power’s Revenue Breakdown, split across Fuel delivered to customers, Power purchase agreements, Sales of fuel cell systems and related infrastructure, Services performed on fuel cell systems and its infrastructure and Others segments.

Plug Power’s Revenue Breakdown

The following table highlights Plug Power’s Revenue Breakdown in some of its recent quarters:

| Vertical | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Sales of fuel cell systems and related infrastructure | $83.53 | $99.28 | $115.99 | 80.60% |

| Fuel delivered to customers | $9.83 | $11.12 | $11.56 | 8.03% |

| Power purchase agreements | $6.70 | $8.36 | $9.32 | 6.48% |

| Services performed on fuel cell systems and related infrastructure | $6.83 | $5.67 | $6.68 | 4.64% |

| Other | $0.09 | $0.12 | $0.37 | 0.26% |

| Total | $106.98 | $124.55 | $143.92 | 100.00% |

(All figures in millions, except percentages)

Sales of fuel cell systems and their affiliated infrastructure

A major part of revenues earned by the company comes from this category which primarily comprises sales of the company’s fuel cells namely, GenDrive units and GenSure stationary backup power units, as well as hydrogen fuelling infrastructure. Revenue from sales of fuel cell systems and related infrastructure grew by 38.86%, amounting to $83.53 million in Q3 2020 to $115.99 million in Q3 2021, on a year-on-year basis. The main cause for the upsurge in revenue was the increase of GenDrive units recognized as revenue, marked by 9533 units in 2021 from 7217 units in 2020, and an increase in hydrogen installations associated with 16 hydrogen sites in Q3 2021 compared to 18 during Q3 2020.

Fuel delivered to customers

Revenue from this category comes from the sale of hydrogen to customers. The company mostly purchases fuel from third parties and occasionally generates it on-site. Revenue from fuel delivered to customers raised from $9.83 million in Q3 2020 to $11.56 million in Q3 2021, marking a 17.6% increase on a year-on-year basis. The upsurge was noticed due to an increase in the number of sites with fuel contracts, from 94 sites in Q3 2020 to 141 in Q3 2021. The increase of site was not proportionate to the increase in revenue because a number of newly established sites had not received fuel in Q3 2021.

Power Purchase Agreements(“PPA”)

This category includes revenue earned from the payments received from customers for generating power through the company’s GenKey solutions. Revenue from PPAs increased from $6.70 million in Q3 2020 to $9.32 million in Q3 2021, marking an increase of 39% on a year-on-year basis. There were almost 61 GenKey sites associated with PPAs in Q3 2021, as compared to 36 in Q3 2020. The growth in revenue was primarily due to new customers accessing the PPA subscription solution and from existing customers who operated through newly established sites.

Services performed on fuel cell systems and their affiliated infrastructure

This category includes revenue earned from service and maintenance contracts and sales of spare parts. Revenue from Services performed on fuel cell systems and related infrastructure decreased by 2.2%, to $6.68 million in Q3 2021 as compared to $6.83 million in Q3 2020. The main cause for the decrease in revenue was the decline in billings for run-time hours that exceeded certain levels because of changes in the overall contract. There were 78 hydrogen installations under extended maintenance contracts and 18,685 fuel cell units in Q3 2021, which comparably increased from 56 hydrogen installations and 13,421 fuel cell units in Q3 2020. Although the number of installation and cell units increased compared to the previous year, many of the units and sites installed late during the quarter hence notable impact will likely commence in Q4 2021.

About the company

Plug Power Inc. is a leading provider of commercially viable hydrogen and fuel cell product solutions. It was established in 1997 and their headquarter is situated in Latham, New York. The company’s aim is to shift the viable market to an increasingly electrified world with an innovative solution of cutting-edge green hydrogen (hydrogen fuel produced using electrolysis and renewable resources) and fuel cell solutions. It has installed over 40,000 fuel cell systems and accelerated its vertical integration through acquisitions of United Hydrogen Group Inc. (“UHG”) and Giner ELX Inc. (“Giner ELX”). The company predominantly serves its products and services in the material handling markets of North America, Europe, and Asia.

Did you like Plug Power’s Revenue Breakdown statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.