NAND Revenue by Manufacturers Worldwide (2014-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

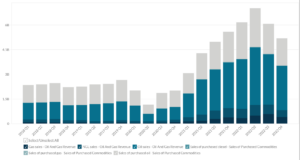

This chart shows NAND Revenue by Manufacturers Worldwide, across Samsung, Micron, SK Hynix, Toshiba and Western Digital, starting from Q2 2014.

This article will give you an insight into the NAND market and the revenue that the market is generating. Flash memory is an electronic non-volatile computer memory storage medium that can be electrically erased and reprogrammed. NAND is one of the most common kinds of flash memory.

NAND – “NOT AND”. It is a non-volatile memory that is used in storage devices such as MP3 players, USB’S, SD cards, etc. The closest substitute to NAND is the NOR flash memory. NAND’s various characteristics include low power requirement, scalable design, cost-effective, and high-density, making it an ideal choice to fuel the demand for new electronic devices that are entering the global market.

NAND Revenue by Manufacturers Worldwide

NAND manufacturers collectively generated $17.91 billion in revenue during Q1 2022. Samsung was the largest NAND manufacturer in terms of revenue, with SK Hynix, Toshiba and Micron occupying the second, third and fourth positions, respectively.

| Manufacturer | Revenue in Q3 2021 | Revenue in Q4 2021 | Revenue in Q1 2022 |

| Micron | 1.97 | 2.615 | 1.957 |

| Others | 0.6206 | 0.7184 | 0.79 |

| SK Group (Hynix + Solidigm) | 0 | 0 | 3.225 |

| SK Hynix | 2.544 | 2.62 | 0 |

| Samsung | 6.51 | 6.11 | 6.32 |

| Solidigm (prev. Intel) | 1.105 | 0.996 | 0 |

| Toshiba (KIOXIA) | 3.638 | 3.543 | 3.3845 |

| WDC | 2.49 | 2.62 | 2.243 |

| Total | 18.8776 | 19.2224 | 17.9195 |

(All figures in USD billion)

The market for NAND saw a big increase after the supply shortage between 2016 and 2018. The markets are concentrated mainly in Asia – Pacific and North American regions. The market for NAND is expected to grow at a steady rate with technological advancement globally.

The key players operating in the global NAND Flash Memory market include Samsung (South Korea), Toshiba (Japan), SanDisk (The U.S), Micron Technology (The U.S), Hynix (South Korea), Intel (The U.S), Powerchip Technology Corporation (Taiwan) and Renesas Electronic (Japan) among others.

NAND shipments grew by 10% quarter on quarter in the last quarter of 2019. The prices also made a rebound due to the shortage. A minor decline is expected in the first quarter of 2020 owing to the COVID -19 outbreak. For most of the NAND suppliers, average selling prices continue to decline, a trend that started in the third quarter of 2018.

The demand for Samsung’s flash bits exceeded the supply. Samsung’s bit shipments increased by almost 10%. Samsung’s NAND flash revenue rose by 11.6 % to $4.451 billion. Toshiba’s bit shipments rose by 20% over the previous quarter and its revenue increased by 12%. Sk Hynix’s bit shipment grew by 10% in the fourth quarter of 2019. It’s NAND flash revenue increased by 5.4% to $1.207 billion. Western Digital’s bit shipment rose by 24% due to the demand placed by Apple’s new iPhones and the rapid rise in data center SSD demand. WD’s NAND flash revenue increased by 12.6% to $1.838 billion. Micron’s bit shipment increased by 15%. Micron’s revenue increased by 18.1% to $1.422 billion. Intel’s bit shipment grew by almost 50% and it’s NAND flash revenue increased by 37.2% to $1.297 billion.

In 2018, the 3D NAND segment had a significant market share, and this trend is expected to continue over the coming few years.

The smartphone and AI segment in particular are key drivers for the NAND market. These sectors have been growing rapidly over the years and are expected to continue doing so, which provides a great platform for growth in NAND markets.

Did you like NAND Revenue by Manufacturers Worldwide statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.