Excise Taxes on Cannabis 2020

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

Excise Taxes on Cannabis 2020

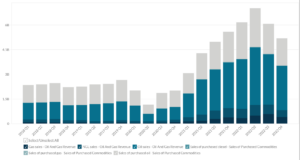

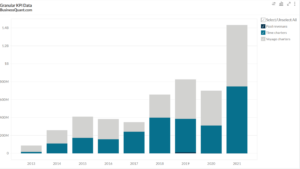

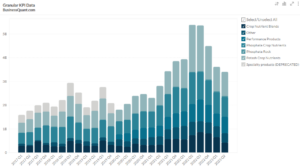

This article discusses the statistics on the Excise Taxes on Cannabis 2020. Although marijuana sales are prohibited under the United States federal law, it is presently legal and taxable in seven states. These states are California, Nevada, Alaska, Colorado, Massachusetts, Washington and Oregon. In 2018, marijuana became legal and taxable in Michigan as well. A majority of these states levy tax on consumer purchase of the drug while others levy tax on the dealings between cultivators and distributors or retailers. In Canada, a licensed cannabis producer is subject to excise duty under federal law as soon as the delivery is made to the purchaser.

Importance of tracking excise taxes on cannabis

Cannabis, like any other drug, has a very active black market. The imposition of excise taxes can and does affect the sourcing of this psychoactive drug. Too high taxes could steer consumers towards illicit and unlicensed producers, while too low taxes would affect revenue generation for the government.

Excise taxes as a metric

Excise duties are generally deducted from gross revenue to arrive at net revenue. Hence, a high amount of excise tax might reduce the top-line revenue. So a relatively lower excise duty would be a positive performance indicator for a cannabis company.

Industry performance based on excise taxes

Aurora Cannabis Inc. had a 35% drop in excise duties from Q2 to Q3 of FY 2019. There was a welcome change from the 29% and 51% rise QoQ in Q1 and Q2 FY 2019. Ontario based cannabis health and wellness provider Aleafia Health had a 197% increase in the excise duty paid on its products from Q2 to Q3 FY 2019.

Innovative global cannabinoid company Cronos Group had an increase in its excise tax by CAD 89,000 i.e. 16% from Q2 to Q3 FY 2019. New Cannabis Ventures paid 4% less excise duty in Q2 FY 2019 from Q1 and 15% fewer taxes in Q3 FY 2019 from Q2. In the first quarter of 2019, it paid 13% more taxes than the fourth quarter of FY 2018.

The 2018 winner of seven Canadian Cannabis Awards – CannTrust Holdings is a federally licensed provider of medical cannabis. The company had a 29% fall in its excise duty from Q4 FY 2018 to Q1 FY 2019. In the fiscal year 2019, Emerald Health faced a decline of 6% from Q1 to Q2 and of 7% from Q2 to Q3.

The Supreme Cannabis Company is a pharmaceutical company engaged in the production and sales of medical marijuana. The company had a whopping 127% increase in taxes from Q1 to Q2 FY 2019. This increase fell to 28% in Q3. Zenabis had a 96% rise from Q1 to Q2 FY 2019. From Q2 to Q3, however, there was just a 7 basis points increase.

Since Q1 FY 2017, Tilray faced its first double-digit rise of 42.66% from Q4 FY 2017 to Q1 FY 2018. In Q1 FY 2019, this QoQ rise fell to 37.50%. However, in the subsequent quarter, there was a 95.74% rise QoQ. The Green Organic Dutchman incurred excise duty of 87,000 CAD in the third quarter of the current year.

After a 219.76% increase from Q1 FY 2019 to Q2, OrganiGram had a reduction in its excise taxes of 14.19% in Q2 from Q1 and of 47.51% in Q3 from Q2. HEXO incurred CAD 11.91 million of excise duty in the third quarter of the current fiscal year.

Flowr Corp. faced a 179.46% rise QoQ in Q2 FY 2019. This was preceded by a 53.63% decrease QoQ in Q1 and was succeeded by another decline of 40.62% QoQ in Q3. Licensed medical grade cannabis produced Indiva Ltd., faced a quarterly downtrend of 28.89% in Q2 FY 2019 and of 21.88% in Q3.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.