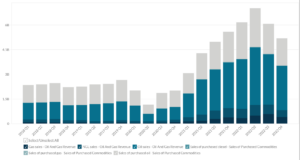

Aurora Cannabis’ Revenue by Product Category (2017-2023)

Exclusive Data

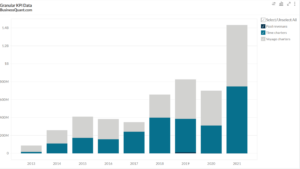

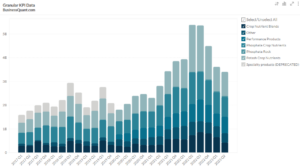

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights Aurora Cannabis’ Revenue by Product Category, reported on a quarterly basis from Q1 2017 onwards.

Aurora Cannabis is a leader in global Cannabis industry with around fifteen production facilities of which two are EU GMP certified. The dynamic growth strategy designed to attain large scale growth and long-term, sustainable profitability has enabled the company to capture greater margins across the cannabis industry value chain. The company derives its revenue from three major products: cannabis extract, dried cannabis and others. As of Q3 2019, the revenues from the different cannabis related products came in at. And let’s look into Aurora Cannabis’ Revenue by Product Category here.

Aurora Cannabis’ Revenue by Product Category

Products |

Revenue (in million USD) |

Revenue Contribution |

| Cannabis Extract* | 10.612 | 14.10% |

| Dried Cannabis | 48.04 | 63.85% |

| Other | 16.586 | 22.04% |

| Total Revenue | 75.238 | 100.00% |

*Cannabis extracts revenue includes cannabis oils, capsules, soft gels, sprays and tropical revenue. (Product wise revenue)

The company generates revenue primarily from the sale of cannabis, cannabis related products like cannabis extract, dried cannabis and provision of services. Cannabis extracts include a wide variety of products such as the extract of the cannabis plant, including extracts from marijuana and hemp. These are much higher in weight compared to dried cannabis and contain high levels of cannabinoids like CBD and THC. Dried cannabis is basically the dry form consumed as a drug or for recreational (smoking) purposes.

The company uses contract-based analysis of transactions to determine revenue recognition. Revenue from the sale of cannabis related products is generally recognized when there is a transfer of control over the goods to the customer. These products are sold either for medical or recreational purposes. Payment is subject to the usage of these products.

The maximum contribution to the company’s revenue from the sale of cannabis related products comes from dried cannabis which is around 63.85 per cent, which represents a marginal 6.63 per cent increase as compared to Q2,2019.

Other category of products contributes around 22 per cent of the company’s revenue while recording a whopping 158 per cent increase as compared to Q2,2019 figures.

Company Overview

Aurora Cannabis Inc., headquartered in Edmonton, is a Canadian licensed cannabis producer. The company is publicly trading on the Toronto Stock Exchange as ACB. The bulk of the company’s capacity is based in Canada with a growing international presence in markets like Denmark and Latin America.

ACB is the second largest cannabis producing company in the world in terms of market capitalization, after Canopy Growth Corporation. Today, it is growing company with over fifteen strategic acquisitions since August,2016.

The company operates on a mass scale, high tech production model to meet the growing cannabis demand in the medical and consumer markets. They have a sustainable, low cost advantage driven by their extensive use of automation techniques for production. The company is motivated to invest extensively in Research and Development (R&D) activities to create optionality and high-margin products with an intent to drive both near-term and medium-term profitability.

Found Aurora Cannabis’ Revenue by Product Category helpful?

Access more interactive datasets such as this, by registering for Free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.