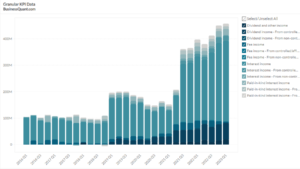

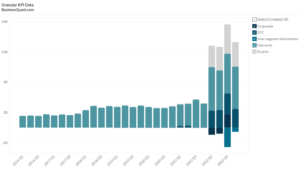

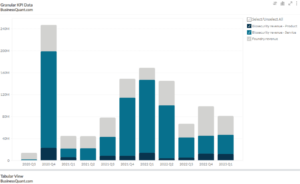

x86 vs non-x86 server revenue (2014-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights x86 vs non-x86 server revenue.

X86 is the generic name for Intel processors that released after the 8086 processor. The x in x86 stands for different possible number combinations. X86 is short for 80 x 86.

There are different types of x86 processors and their full names are – 80286, 80386, 80486 and 80586. The x86 processors are backwards compatible, which means they can run all programs that the older processors could run, but the older processors cannot run x86 programs. Majority of the personal computers and laptops are based on the x86 system.

Total worldwide server revenue grew by 7.5% in the last quarter of 2019, whereas shipments increased by 14% to just over 3.4 million units.

Revenue generated from x86 servers increased by 6.5% to $22.6 billion in the last quarter of 2019. HPE and its China based H3C group gained a 16.3% market share overthrowing Dell who has 15.7% of the market share to become the market leaders. IDC called it a tie for the market leader position, as it was a difference of less than 1%. Having said this, HPE’s revenues were down by 3.4 % while Dell’s revenue dropped by almost 9.9%.

In terms of units shipped Dell was leading the market with 549,488 units shipped whereas HPE shipped 507,228 units during the last quarter of 2019. Coming in third was IBM growing at 17.76% and having a share in the revenue of 9.1%. Inspur Power Systems was fourth growing at 12.1% Yoy and having a 6.8% market share. Lenovo and Huawei were tied for the fifth position with market shares of 5.6% and 5.1 % respectively. Huawei’s revenue grew 1.8% in the fourth quarter while Lenovo saw a fall in revenue by 2.6%.

There are a few non x86 processors like MIPS and ARM. These are generally used in smaller single board computers. ARM is used in smartphones and tablets, as they require a high volume. ARM allows other chip manufacturers to use its technology. Non-x86 servers revenue grew by 17.7% year over year to just below $3.0 billion. IBM is the leader in the non x86 market. ARM, MIPS, Imagination, etc. have lost their market share in recent years.

The microprocessor and GPU market is expected to be worth $83.69 billion by 2022, with a forecasted CAGR of 2.2% between 2017 and 2022. However, the availability of low-cost solutions and the preference towards portable devices over larger and heavier devices are affecting the revenue and profit margins of the companies. Though the volume of business would remain the same, the overall market size will be affected by the availability of low-cost solutions to consumers.

Did you like this statistic highlights x86 vs non-x86 server revenue? Get access to more such datasets by registering for Free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.