V.F. Corp’s Revenue Breakdown Worldwide (2016-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

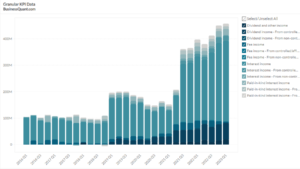

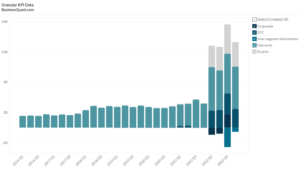

This statistic highlights V.F. Corp’s Revenue Breakdown Worldwide, split across Net Sales, and Royalty Income, reported on a quarterly basis from Q1 2016 onwards.

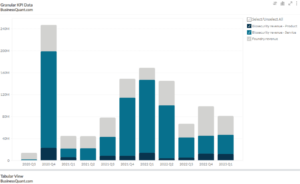

V.F. Corp’s Revenue Breakdown Worldwide

| Revenue by Business Vertical | Q1 2021 | Q4 2021 | Q1 2022 | Contribution in Q1 2022 |

| Net sales | $1,063.42 | $2,568.15 | $2,181.48 | 99% |

| Royalty income | $12.87 | $14.52 | $13.08 | 1% |

| Total | $1,076.29 | $2,582.67 | $2,194.56 | 100% |

(All values are in millions, apart from percentages)

V.F. Corporation generates most of its revenue from net sales. In Q1 2022, 99% of their revenue was generated by net sales, while only 1% of the revenue was generated from royalty income. The total revenue generated in Q1 2022 was $2,194.56 million, which indicates an increase in the year-on-year basis index by 103.9% from Q1 2021, in which the revenue generated was $1,076.29 million. Under the quarter-on-quarter scale, revenue in Q1 2022 decreased $388.11 million, or 15.02%, compared to $2,582.67 million in Q4 2021.

The growth was primarily driven by recovery from the negative impact of COVID-19 on demand and distribution channels in the prior year periods, which included temporary closures of VF-operated retail and VF’s wholesale customer stores. These growth rates have been influenced in the current quarter by supply chain disruption, including port delays, lengthened transit times, logistics issues, and supplier production challenges.

V.F. Corp’s revenue can be bifurcated into the following business verticals:

Net Sales

Net sales of the company are derived from Direct-to-Customer and Wholesale channel. The company’s products are marketed to consumers through wholesale channel, primarily in specialty stores, national chains, mass merchants, department stores, independently-operated partnership stores and with strategic digital partners. The products are also retailed to consumers through the direct-to-consumer channel, which includes VF-operated stores, concession retail stores, brand e-commerce sites, and other digital networks.

Net sales increased tremendously from $1,063.42 million in Q1 2021 to $2,181.48 million in Q1 2022, marking a huge growth of 105.1% on a yearly basis. However, on a quarter-on-quarter scale, it decreased $386.67 million, or by 15.05% as compared to $2,568.15 million in Q4 2021. Net sales form the major part of the company’s total revenue, i.e. 99% in Q1 2022.

For the latest quarter of 2022, revenue witnessed growth in both wholesale and direct-to-customer channels. The overall increase in the direct-to-consumer channel was driven by reopenings of the retail stores, which had temporary closed in the prior year periods as a consequence of the COVID-19 pandemic, and the contribution from the Supreme acquisition during this period. The overall growth in the wholesale channel also reflects a recovery from the undesirable effect of COVID-19 on prior year periods.

Royalty Income

As part of the company’s strategy of enlarging market penetration of VF-possessed brands, it enters into licensing contracts with independent parties for particular apparel and complementary product categories when similar exhibitions provide additional effective manufacturing, distribution and marketing than could be achieved internally. Licensing contracts relate to a broad range of VF brands and are for specified terms of generally 3 to 5 years, with a tentative renewal choice. Each licensee pays royalties to VF on the basis of its sales of licensed products, with most agreements providing for a minimum royalty requirement.

Royalty income increased slightly increased from $12.87 million in Q1 2021 to $13.08 million in Q1 2022, witnessing a growth of 1.6% on a yearly basis. Besides, it fell by 9.9% as compared to $14.52 million in Q4 2021, on a quarter-on-quarter basis. Royalty income comprises only 1% of the company’s total revenue for the period Q1 2022.

About V.F. Corporation

Founded in 1899, V.F. Corporation is one of the global leaders in apparel, footwear and accessories companies, connecting people to the lifestyles, activities and experiences they cherish most through a family of iconic outdoor, active and workwear brands. VF has diversified its portfolio across various brands, product categories, geographies, distribution channels and consumer demographics. It owns a broad portfolio of brands in the outerwear, footwear, apparel, backpacks, luggage, and accessories categories. The company’s biggest brands are Vans, The North Face, Timberland and Dickies. VF’s diverse portfolio meets consumer demands across a broad scale of activities and different ways of living. The company’s ability to connect with consumers, as diverse as the brand portfolio, creates a unique platform for sustainable, long-term growth.

On December 28, 2020, VF completed the acquisition of the outstanding shares of Supreme Holdings, Inc. On June 28, 2021, VF sold its Occupational Workwear business. The Occupational Workwear business was comprised primarily of the following brands and businesses: Red Kap, VF Solutions, Bulwark, Workrite, Work Authority and Horace Small.

Did you like V.F. Corp’s Revenue Breakdown Worldwide statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.