Recreational Cannabis Volume Sold 2020

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

Recreational Cannabis Volume Sold 2020

This article discusses the statistics on Recreational Cannabis Volume Sold 2020. Recreational cannabis is marijuana that is used ‘without medical justification.’ Such type of marijuana has more THC than the medically prescribed drug. THC is a psychoactive compound which gives the user a “high” sensation. While the drug has been used medically and otherwise since centuries, it was only in 1931 that 29 states within the U.S. banned it altogether. However, between 2000 and 2011, more than 12 states legalized medical marijuana. In 2012, Washington and Colorado were the first states to decriminalize recreational cannabis for certain adults. Recently, Illinois joined the rank of 10 states and the District of Columbia by adopting a comprehensive law that will permit recreational use of cannabis from January 1st, 2020. It is also the first state to legalize retail sales through its Legislature. This move is expected to generate up to the US $ 2.5 billion per annum for the state.

Importance of tracking the volume of recreational cannabis sold

According to the 2018 data of cannabis analytics firm Headset, the average category sales of recreational cannabis increased in excess of 50% during the pre-Christmas season in the states of Colorado, Washington, California and Nevada. This included both personal consumption and gift-giving sales. Furthermore, based on a 2017 New Frontier Data report, 55% of American adults consume marijuana to relax, while 40% use the drug to enjoy social experiences or to relieve stress. In contrast, only 15% use cannabis to treat a medical condition. Hence, it is imperative to track the sales volume of recreational cannabis sold.

Sales volume of recreational cannabis as a metric

Volume sales of recreational cannabis are measured in kilograms. A relatively higher volume of recreational cannabis sold would be a positive performance indicator for a cannabis company.

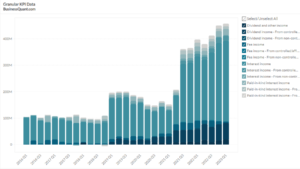

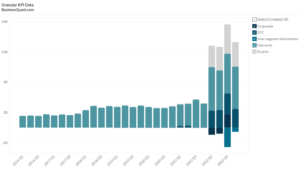

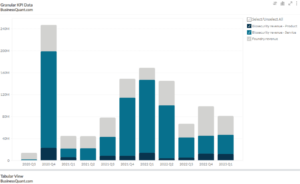

Industry performance based on the volume of recreational cannabis sold

Aurora Cannabis had a 74% increase in its volume sales of consumer cannabis from Q1 to Q2 FY 2019. This was succeeded by a 35% decline from the second to the third quarter of the current fiscal year.

Canopy Growth Corp. faced its highest sales of 9,060 kilograms during Q2 FY 2019. This was a 14% rise from the previous quarter and was sandwiched between a 4% and a 2% decline QoQ in Q1 and Q3 FY 2019, respectively.

There was a triple digit growth in recreational cannabis sales of Aphria Inc., in Q2 FY 2019. This amounted to a 143% rise from Q1, during which there was a 32% decline from the fourth quarter of FY 2018. In Q3 FY 2019, there was just a 3% rise from Q2.

Delta 9 sold 386 kg of consuming cannabis in the first quarter of FY 2019. This rose by 34% to 518 kg in the second quarter of the same year. The sales volume of Emerald Health increased at a decreasing rate in the first three quarters of 2019. The company’s highest rise was of 208% QoQ in Q1 FY 2019. This fell substantially to a 25% rise QoQ in Q2.

OrganiGram had a 188% jump in sales from 3,099 kg in Q4 FY 2018 to 8,940 kg in Q1 FY 2019. In Q2 and Q3 FY 2019, the company faced a decline of 13% and 45%, respectively.

HEXO also had a triple digit growth of 166% from 952 kg in Q4 FY 2018 to 2,537 kg in Q1 FY 2019. In Q2 FY 2019, the QoQ growth fell to 9%, but the company picked up sales with a 45% rise QoQ in Q3.

VIVO followed a 37% decline from Q4 FY 2018 to Q1 FY 2019 with a 48% increase QoQ in Q2 FY 2019. However, this rise fell to 20% QoQ in Q3 FY 2019.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.