PC Shipments by Vendor (2018 – 2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

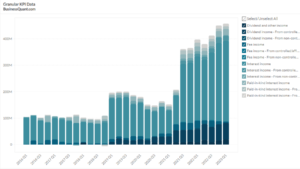

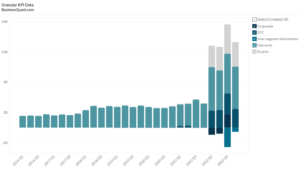

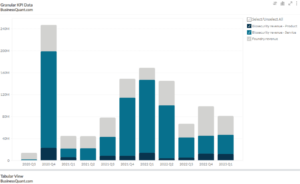

This statistic highlights PC shipments by Vendor. Research firm Canalys defines PCs as Desktop, Notebook or a Workstation systems. The largest PCs vendors at the end of 2020 happen to be Acer, Apple, Dell, HP, Lenovo amongst a few other names. Lenovo leads the pack with HP close behind it in the second spot and Acer coming in at the third spot. Industry shipments during Q1 2020 came in at 53.6 million units, which was nearly 8% down on a year over year basis due to the COVID-19 outbreak. However, the PC industry shipments rebounded sharply in the subsequent Q2 and Q3 of 2020.

As far as PC shipments by vendor break-up is concerned:

- Lenovo accounts for about 24.22% share in the PC market. Lenovo shipped approximately 19.27 million during Q3 2020, up 11% year over year.

- HP accounts for about 23.50% share in the market. Its shipments for Q3 2020 stood at 18.66 million, up 11.5% year over year.

- Dell shipments, on the other hand, shrank by 0.7% year over year. Its shipments for the period came in at 11.9 million units which represented a 15% market share in the PC market.

- Apple accounts for about 7.31% share in the PC market for PC shipments. Its shipments grew at the fastest pace in our study group, rising 18.5% year over year during Q3 2020. This was an impressive feat given that it managed to grow shipments at a staggering pace in spite of its generally-lofty price points.

- Acer has a relatively small grasp over the industry with a moderate 6.61% PC market share. However, it rapidly gained ground in Q3 2020 with an impressive, second-best, shipment growth figure of 15%.

Here’s the complete PC shipments by Vendor dataset for Q3 2020:

| Shipments (in Mn) | Shipment Growth | Market Share | Market Share Change (bps) | |

| Lenovo | 19.27 | 11.3% | 24.3% | -9.5 |

| HP | 18.66 | 11.5% | 23.6% | -5.9 |

| Dell | 11.989 | -0.7% | 15.1% | -190.8 |

| Apple | 6.372 | 18.5% | 8.0% | 45.8 |

| Acer | 5.638 | 15.0% | 7.1% | 19.8 |

| Others | 17.277 | 19.5% | 21.8% | 140.7 |

It’s evident that Dell lost a significant amount of market share (190 basis points) whereas Apple gained ground during the period with an increase of almost 46 basis points.

For the record, Apple hadn’t released its new line of ARM-based Macs, MacBooks and iMacs by Q3 2020-end which means that most of its market share gains were driven by its relatively dated machines that came equipped with Intel-based chips. The COVID-19 pandemic has encouraged people to shift to the work-from-home environment and also disrupted supply chains across the globe. This might have played a vital role in the market share shake-up as seen above.

Did you like PC shipments by Vendor statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.