Lennar Corp’s Revenue by Segment (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

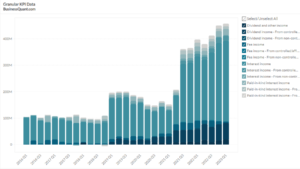

This statistic highlights Lennar Corp’s Revenue by Segment by segment, split across homebuilding, financial services and multifamily segments, reported on a quarterly basis from Q1 2016 onwards.

Lennar Corp’s Revenue by Segment

| Segment | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Homebuilding | $5.505 | $6.028 | $6.558 | 94% |

| Financial Services | $0.237 | $0.219 | $0.207 | 3% |

| Multifamily | $0.115 | $0.177 | $0.168 | 2% |

| Lennar Other | $0.013 | $0.006 | $0.008 | 0.12% |

| Total | $5.870 | $6.430 | $6.941 | 100.00% |

(All figures are in billions, except percentages)

The company’s total revenue increased from $5.870 billion in Q3 2020 to $6.941 billion in Q3 2021, marking a growth of approximately 18% on a year-on-year basis. The revenue also grew by $0.511 billion in Q3 2021 as compared to Q2 2021, marking a growth of about 8% on a quarter-on-quarter basis.

Homebuilding

This segment includes construction as well as sale of various types of homes and also the purchase and development of residential lands directly. The company acquires the land and then constructs homes for buyers. The home prices depend upon both, the product and its location. The company aims at increasing its access to lands through joint ventures. The company has a diversified line of homes for different buyers.

The total revenue from this segment increased from $5.505 billion in Q3 2020 to $6.558 billion in Q3 2021, representing a growth of approximately 19% on a year-on-year basis. There was also a growth of approximately 8.8%, with revenue standing at $6.558 billion in Q3 2021 as compared to$6.028 billion in Q2 2021. Overall, this segment had the maximum share of 94.5% in the company’s revenue.

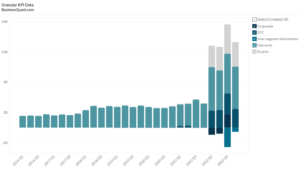

Financial Services

The company offers residential mortgage loans that are both FHA-insured and VA- guaranteed. It also provides other home mortgage products to the buyers of its home through this segment. The company finances its activities through borrowings or from operating funds. The company also automates the loan origination process through various technologies. This has been beneficial in covid-19 and has increased the number of digital closings too. The company also issues floating-rate loans too.

The total revenue from the financial services segment declined from $0.237 billion to $0.207 billion from Q3 2020 to Q3 2021, showing a fall of approximately 12.7% in revenue on a year-on-year basis. There was also a decline of approximately 5.5% on a quarter-on-quarter basis, from $0.219 billion in Q2 2021, when compared to $0.207 billion in Q3 2021. This segment accounted for approximately 3% of the total revenue of this company.

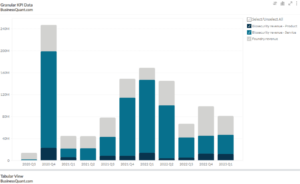

Multifamily

The company is actively involved in the construction of multifamily rental properties. It focuses on developing portfolios that are geographically diversified and of institutional quality too. It is one of the largest developers of apartments across the United States.

This segment had a share of 2.4% in the company’s total revenue in Q3 2021. The revenue increased from $0.115 billion to $0.168 billion from Q3 2020 to Q3 2021, marking a 46% growth in revenue on a year-on-year basis. On the other hand, the revenue fell by approximately 5% on a quarter-on-quarter basis, from $0.177 billion in Q2 2021 to $0.168 billion in Q3 2021.

Lennar Other

The company also invests in ventures that enhance the home buying experience and initiate homebuilding innovation. Some of those strategic investments include those in Opendoor, Blend and Hippo Analytics among others.

This segment had the least share of 0.12% in the company’s total revenue in Q3 2021. The revenue declined from $0.013 billion to $0.008 billion from Q3 2020 to Q3 2021, marking a 38.5% fall in revenue on a year-on-year basis. On the other hand, the total revenue from this segment increased from $0.006 billion to $0.008 billion from Q2 2021 to Q3 2021, marking a 33.33% growth on a quarterly basis.

About the company

The company was founded in 1954 and got listed on the New York Stock Exchange in 1972. It has its operations in Florida, Illinois, Utah, Oregon, Texas, and many more locations. The company also acquired many regional homebuilders which helped strengthen its position and to diversify its existing markets. The company’s main operation is its homebuilding segment, which accounted for 93% of its consolidated revenues in 2020.

The company is the largest homebuilder in the US by net earnings and revenue. It is also an originator of residential as well as commercial mortgage loans and also provides title insurance. It develops multifamily rental properties too. Its interest lies in companies that are engaged in applying the latest technologies to improve this homebuilding industry and the real estate aspects of the industry. In addition, it is also involved in a venture that invests in single-family rental homes. During the Covid-19 pandemic, the company took various technology initiatives like selling homes virtually or digital closings, which made the home sale process safer.

Did you like Lennar Corp’s Revenue by Segment statistic?

Access more such key performance indicator (KPI) data points, on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.