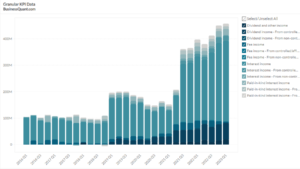

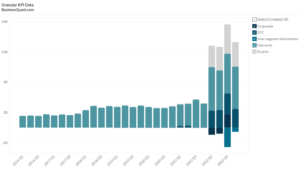

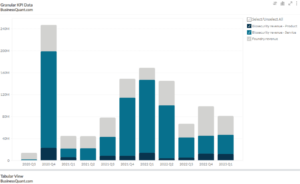

Intel and AMD Shipment Growth (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights Intel and AMD’s shipment growth, reported on a quarterly basis from Q1 2016 onwards.

Industry performance based on Intel and AMD shipment growth

AMD’s computer and graphics segment outperformed all the other competing segments of Intel with a positive 10% growth from Q2 FY 2019 to Q3. The company’s highest quarterly growth was of 20% from Q4 FY 2017 to Q1 FY 2018, and again from Q2 FY 2018 to Q3. Since Q1 FY 2018, AMD had its only QoQ decline of 8% in Q1 FY 2019.

The desktop client computing group segment of Intel fell far from its 20% increase QoQ in Q2 FY 2017, to a 2% quarterly rise in Q3. It picked up with an 8% rise from Q2 FY 2018 to Q3, but faced a 7% fall from Q4 FY 2018 to Q1 FY 2019, and again from Q2 FY 2019 to Q3.

Intel’s notebook client computing segment faced a downtrend from Q2 FY 2017 to Q2 FY 2018, and again from the first to the third quarter of the current fiscal year. The highest decline was of 9% from Q1 FY 2018 to Q2. There was a sole positive growth of 1% from Q2 FY 2018 to Q3.

The platform datacenter group of Intel had a 16% growth QoQ in Q1 FY 2018. This gradually declined to a -12% from the first to the second quarter of 2019. In Q3 FY 2019, there was a 6% decline from Q2.

Intel and AMD shipment growth: Shipments growth refers to the percentage increase or decrease in the number of units shipped by both Intel and Advanced Micro Devices Inc., between two periods.

Importance of tracking Intel and AMD shipment growth

The amount of units shipped by either company will determine the market share claimed or lost and whether or not the two companies are able to meet demand.

Intel and AMD shipment growth as a metric

A relatively higher rate of growth in shipments would be a positive performance indicator for both the companies.

Did you like Intel and AMD’s shipment growth statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.