General Dynamics’ Revenue by Segment (2016 – 2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

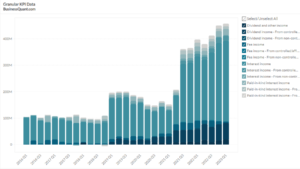

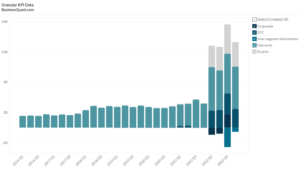

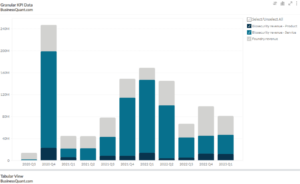

This statistic highlights General Dynamics’ Revenue by Segment, split across Aerospace, Combat Systems, Marine Systems, Mission Systems, and Technologies, reported on a quarterly basis from Q1 2016 onwards.

General Dynamics is a worldwide aerospace and military corporation that specializes in the precise design, engineering, and production to provide clients with cutting-edge solutions. The company provides a diverse range of goods and services in business aviation, shipbuilding and maintenance, ground combat vehicles, weapons systems and ammunition, and technology products and services. The company’s dominant positions in the profitable business aviation and military industries allow it to provide better and long-term shareholder returns.

General Dynamics’ Revenue by Segment

| Segment | Q1 2020 | Q1 2021 | YOY Growth | Revenue Share in Q1 2021 |

| Aerospace | $1.69 | $1.89 | 11.83% | 20.13% |

| Combat Systems | $1.71 | $1.82 | 6.43% | 19.38% |

| Marine Systems | $2.25 | $2.48 | 10.22% | 26.41% |

| Mission Systems | $1.12 | – | – | – |

| Technologies | $1.99 | $3.20 | 60.80% | 34.08% |

| Total | $8.76 | $9.39 | 7.19% | 100.00% |

(All figures in billions, except percentages)

General Dynamics’ total revenue rose from $8.76 billion in Q1 2020 to $9.39 billion in Q1 2021, marking a growth of 7.19% on a year-on-year basis in the company’s total revenue.

Aerospace

The Aerospace sector of General Dynamics is known as a major manufacturer of business jets and the industry leader in aircraft repair, maintenance, and completion services. This segment is made up of the Gulfstream and Jet Aviation business units.

General Dynamics’ revenue from Aerospace rose from $1.69 billion in Q1 2020 to $1.89 billion in Q1 2021, marking an increase of 11.83% on a year-on-year basis. During this period, the Aerospace segment contributed 20.13% to the company’s total revenue.

Combat Systems

The Combat Systems segment is a global leader in the design, manufacturing, and integration of land combat solutions, including wheeled and tracked combat vehicles, weapons systems, and ammunition. Land Systems, European Land Systems (ELS), and Ordnance and Tactical Systems are the segment’s three business units (OTS).

General Dynamics’ revenue from this segment rose from $1.71 billion in Q1 2020 to $1.82 billion in Q1 2021, marking a growth of 6.43% on a year-on-year basis. During this period, this Combat Systems segment contributed 10.38% to the company’s total revenue.

Marine Systems

General Dynamics’ Marine Systems segment is the leading designer and builder of nuclear-powered submarines, as well as a leader in surface combatants and auxiliary ship design and building for the United States Navy. In addition, the business provides maintenance, modification, and lifecycle support services for Navy ships. It has the capacity to develop, build, and maintain the nation’s most technologically sophisticated warships, it is a key element of the United States’ defense industrial base.

General Dynamics’ revenue from Marine Systems rose from $2.25 billion in Q1 2020 to $2.48 billion in Q1 2021, marking an increase of 10.22% on a year-on-year basis. During this period, the Marine Systems segment contributed 26.41% to the company’s total revenue.

Mission Systems

Mission Systems provides solutions across all domains and creates unique products and capabilities designed specifically for critical C4ISR and cybersecurity applications. This segment generated $1.12 billion in Q1 2020,

Technologies

General Dynamics Technologies offers a wide range of services, technologies, and products to an expanding industry that increasingly looking for solutions that combine cutting-edge electronic hardware with specialist software.

General Dynamics’ revenue from Technologies rose from $1.99 billion in Q1 2020 to $3.20 billion in Q1 2021, marking an increase of 60.80% on a year-on-year basis. During this period, the Technologies segment contributed 34.08% to the company’s total revenue.

Company Overview

General Dynamics Corporation is a publicly listed American aerospace and military company founded in 1899. Its main office is located in Reston, Virginia, United States. The company was formed in 1954 by the merger of submarine manufacturer Electric Boat company and aircraft manufacturer Canadair company. The corporation now has 10 subsidiary businesses operating in 45 countries. Phebe Novakovic is the current Chairman and CEO of the company.

General Dynamics Corporation faces tough competition from Lockheed Martin, Northrop Grumman, Raytheon, Boeing, BAE Systems, Textron, Cobham, Airbus, and Saab. Its common stocks are traded on the New York Stock Exchange under the trading symbol “GD”.

Did you like General Dynamics’ Revenue by Segment statistic?

Access thousands of more such key performance indicator data points, on listed companies, with Business Quant.

You can also get started for free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.