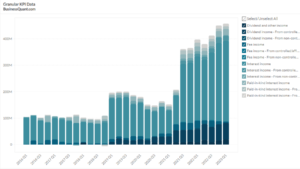

Diamondback Energy’s Revenue by Business Segment (2018-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights Diamondback Energy’s Revenue by Business Segment, split across Midstream services, exploration & production, and other business segments, reported on a quarterly basis from Q1 2018 onwards.

Diamondback Energy’s Revenue by Business Segment

| Business Segment | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Midstream services | $97 | $111 | $12 | 92.3% |

| Exploration and production | $706 | $1,669 | $0 | 0.0% |

| Other | $0 | $0 | $1 | 7.7% |

| Total | $803 | $1,780 | $13 | 100.0% |

(All figures in millions, except percentages)

Q2 2021 was the most prosperous quarter for the company. The total revenue of Diamondback energy declined from $803 million in Q3 2020 to $13 million in Q3 2021, marking a massive 98.4% fall in revenue on a year-on-year basis. The revenue also fell by a significant $1,767 million in Q3 2021 as compared to $1780 million in Q2 2021, leading to a 99.3% fall in revenue on a quarter-on-quarter basis. But the revenue also grew by 121.7% in Q2 2021 when compared to Q3 2020.

The oil prices reached negative numbers in 2020 as they were spurred by the pandemic. But as the demand for oil and natural gas increased in 2021, oil prices started recovering. Due to the uncertainty, it is very difficult to predict the demand or the volatility in prices. Generally, the demand for oil is high during summers as compared to winters, while it is the opposite for natural gas.

Diamondback Energy’s revenue can be bifurcated into the following segments:

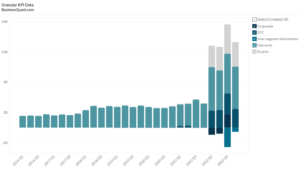

Midstream Services

In this segment, Rattler aims to expand the crude-oil and water-related services and also provide midstream services to third-party producers. It faces a high level of competition from many integrated companies and pipelines that are in the same business.

The total revenue from this business segment declined by $85 million, from Q3 2020 to Q3 2021, marking an 87.6% fall in revenue on a year basis. The revenue also declined from $111 million in Q2 2021 to $12 million in Q3 2021, leading to an 89.2% fall in revenue on a quarter-on-quarter basis. This segment had the highest share of 92.3% in the company’s Q3 2021 revenue, whereas it had a share of just 6.2% in the company’s total Q2 2021 revenue.

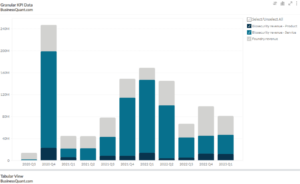

Exploration & Production

This segment experiences weather conditions like severe winter storms and lease issues also limit the drilling operations in many operating areas. The major risk in this segment is the pricing applicable to natural gas and oil production. Pricing has been unpredictable and volatile, especially during the pandemic.

This segment had no share in Q3 2021’s revenue. But on the other hand, it had the maximum share of 93.8% in Q2 2021’s revenue. The revenue declined by $706 million and $1669 million from Q3 2020 to Q3 2021, and from Q2 2021 to Q3 2021 respectively. The decline in revenue was 100% in both these periods.

Other

This segment had a 7.7% share in the company’s Q3 2021 revenue. The revenue grew by $1 million from Q3 2020 to Q3 2021 and from Q2 2021 to Q3 2021 too. Other business services had no share in Q3 2020 and Q2 2021’s revenue.

About Diamondback Energy Inc

Diamondback Energy is an American, independent natural gas and oil company that focuses on the development, exploration, exploitation, and acquisition of onshore, unconventional natural gas and oil reserves in West Texas in the Permian Basin. It is one of the major oil-producing basins in the United States and has an extensive history, favorable environment, long reserve life, multiple horizons for producing, mature infrastructure, a large number of operators, and enhanced recovery potential.

The company headquartered in Midland, Texas mainly focuses on the horizontal development of Wolfcamp and Spraberry formations in the Midland Basin and other formations in the Delaware Basin. These formations have a high concentration of liquids-rich natural gas and oil, various target horizons, high success rates in drilling, and extensive production history, along with long-lived reserves. The common stock of the company is publicly traded on the NASDAQ under the symbol “FANG” and is a component of the S&P 500.

Did you like Diamondback Energy’s Revenue by Business Segment statistic?

Access more such key performance indicator (KPI) data points and segment financials, on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.