CenturyLink’s (Lumen Technologies) Revenue Breakdown (2018-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

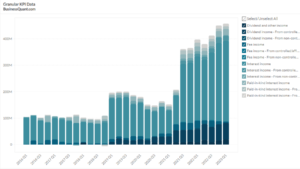

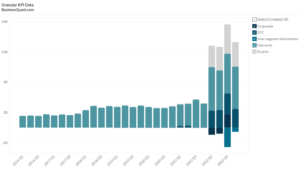

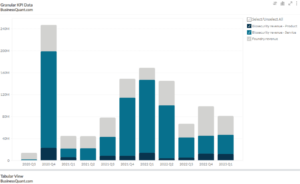

This statistic highlights CenturyLink’s (Lumen Technologies) Revenue Breakdown, reported on a quarterly basis from 2018 onwards.

CenturyLink is an integrated communications company that provides communications services like voice, local and long-distance, network access, private line during special access, broadband, data, managed hosting including cloud hosting, wireless and video service. CenturyLink operates under two operating segments:

Business segments– Through this segment, the company provides its services to small and medium enterprises, wholesale, and government customers.

Consumer segment – Through this segment, the company provides services to residential customers.

The company’s revenue for 2019 was $22.40 billion which was a 4.44% decline from the previous year’s revenue of $23.44 billion. About 2% of the company’s revenue comes from its broadband services,8.5% from regulatory services, 12% from voice, 23% from voice and collaboration,18% from IT and Managed Services, 30% from transport and infrastructure, and the remaining 2-3% from other sources.

In the last quarter of 2018, the broadband revenue was $703 million. The revenue started growing into 2019 and increased to $722 million in the first quarter and then decreased to $718 million in the second and third quarters.

The revenue from IT and managed services was $146 million in the fourth quarter of 2020. The revenue started decreasing in 2019 and fell to $144 million in the first quarter, $135 million in the second quarter, $126 million in the third quarter, and then increased to $130 million in the last quarter of 2019.

Revenue from regulatory services was $180 million in the last quarter of 2018. The revenue then started decreasing into 2019 and fell to $159 million in the first quarter, $158 million in the second quarter, and $157 million in the third quarter. In the fourth quarter revenue from regulatory services rose sharply to $1.38 billion.

The revenue from voice services stood at $505 million by the end of 2014. The revenue then started declining and dropped down to $489 million in the first quarter of 2019, $477 million in the second quarter, and $462 million by the third quarter. The fourth-quarter revenue went up by a huge margin to $2.08 billion.

The voice and collaboration revenue by the end of 2018 was $1.05 billion. The revenue then saw a downtrend and fell down to $1.02 billion in the first quarter of 2019, $1.01 billion in the second quarter, remained unchanged in the third quarter and fell down again in the last quarter to just below $1 billion.

As of the last quarter of 2018 transport and services revenue was $1.36 billion. It fell down to $1.29 billion in the first quarter of 2019, saw no change in the second quarter and then increased to $1.31 billion in the third quarter and remained unchanged till the end of the year.

The revenue from IP and data services was $1.76 billion as of the last quarter of 2018. The revenue declined marginally to $1.75 billion in the first quarter of 2019, declined a little further to $1.73 billion in the second quarter, and then steadied back up at $1.76 billion for the remaining quarters of 2019.

The revenues from IP and data services and transport and infrastructure services have been fairly stable over the past 2 years. The last quarter of 2019 saw a huge boost in revenue figures and can be considered a good sign for the company in the future.

Did you like CenturyLink’s (Lumen Technologies) Revenue Breakdown statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.