Carnival Corporation’s Revenue by Segment (2016-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

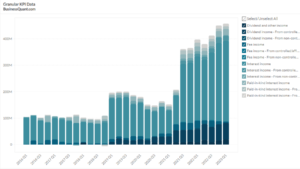

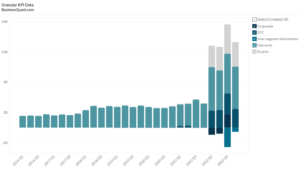

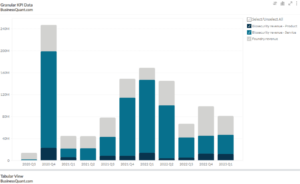

This statistic highlights Carnival Corporation’s Revenue by Segment, split across North America & Australia (NAA), Europe & Asia (EA) , Cruise Support, Tour and others, reported on a quarterly basis from Q1 2016 onwards.

Carnival Corporation’s Revenue by Segment

The NAA and EA reportable segments consist of operating segments that have been aggregated based on the similarity of their economic and other characteristics, including geographic guest sourcing. The Cruise Support division consists of port destinations as well as other services that are all operated for the benefit of the cruise brands. The Tour and Other segment includes Holland America Princess Alaska Tours’ hotel and transportation operations, as well as other functions.

| Revenue by Segment | Q3 2020 | Q2 2021 | Q3 2021 | Revenue contribution in Q3 2021 |

| North America & Australia (NAA) | $15.00 | $9.00 | $271.00 | 49.72% |

| Europe & Asia (EA) | ($4.00) | $33.00 | $232.00 | 42.57% |

| Cruise Support | $1.00 | $0.00 | $14.00 | 2.57% |

| Tour and Other | $20.00 | $7.00 | $28.00 | 5.14% |

| TOTAL | $32.00 | $49.00 | $545.00 | 100% |

(All figures are in millions, except percentages)

The total revenue of Carnival Corporation increased from $32 million in Q3 2020 to $545 million in Q3 2021 marking a 1603.25% growth on a year-on-year basis. It also grew by 1012% as compared to $49 million earned in Q2 2021.

Carnival Corporation revenue is further bifurcated into the following segments:

North America and Australia (NAA)

Carnival Corporation’s key brands in North America and Australia are Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises (Australia), and Seabourn. Carnival Cruise Line is the world’s most popular cruise line, providing excellent service to its passengers. It has 22 ships in its fleet. Princess Cruises has a fleet of 16 ships that sail to Alaska, Australia, Mexico, the Caribbean, the Panama Canal, and a variety of other destinations.

Carnival Corporation’s revenue from the NAA segment increased from $15 million in Q3 2020 to $271 million in Q3 2021 marking an increment by 1706% on a YoY basis. In Q3 2021 the major contribution to the company’s revenue, of approximately 50% was made by the NAA segment.

Europe and Asia (EA)

Costa Cruises, Cunard, AIDA Cruises, and P&O Cruises are among the brands that make up Carnival Corporation’s Europe and Asia business. In Asia, it is headquartered is in Singapore. Costa Cruises is a European cruise line that operates in Italy, Germany, and France. It offers cruises to over 260 destinations worldwide. This luxury cruise line has 10 ships and is Europe’s leading cruise line. AIDA Cruises, a German cruise line, has a fleet of 14 ships. AIDA Cruises provides passengers with world-class entertainment, gastronomic pleasures, and shore excursions.

Carnival Corporation’s revenue from the EA segment escalated by a tremendous amount from a loss of $4 million in Q3 2020 to $232 million in Q3 2021. The EA segment was responsible for contributing 42.57% to the total revenue in Q3 2021.

Cruise Support

The Cruise Support division contains a portfolio of top port destinations as well as additional services that are all operated for the interest of cruise brands.

Carnival Corporation revenue from the Cruise Support segment has increased from $1 million in Q3 2020 to $14 million in Q3 2021 marking a 1300% growth on a YoY basis. However, the cruise industry worldwide, suspended passenger cruise operations in response to the global effect of COVID-19, due to which revenue in Q2 2021 dropped drastically, and became almost negligible.

Tour and Other

The major tour operator in Alaska and the Canadian Yukon, which complements Carnival Corporation’s Alaska cruise operations, is Holland America Princess Alaska Tours. The Tour and Other sectors of the Carnival Corporation own and run hotels, lodges, glass-domed railcars, and motor coaches.

Carnival Corporation revenue from Tour and Other segment showed an increment from $2 million in Q3 2020 to $28 million in Q3 2021 indicating a 1300% growth on a YoY basis.

About the Company

Carnival Corporation & plc, the world’s biggest luxury travel company, offers outstanding holidays at an incredible value to tourists all over the world. Holland America Princess Alaska Tours, a subsidiary of Carnival Corporation, is the premier tour operator in Alaska and the Canadian Yukon. In the United Kingdom, P&O Cruises has a fleet of five luxury ships. The President and Chief Executive Officer of Carnival Corporation and Carnival plc, who is also the CODM, receives reports from the operational segments. After reviewing the results across all segments, the CODM evaluates performance and makes resource allocation decisions for Carnival Corporation & plc. Carnival Corporation’s stock is listed under the ticker symbol CCL on the New York Stock Exchange and the London Stock Exchange.

Did you like Carnival Corporation’s Revenue by Segment statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.