Canopy’s Growth Average Selling Price (ASP)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

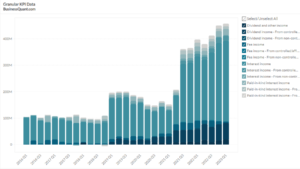

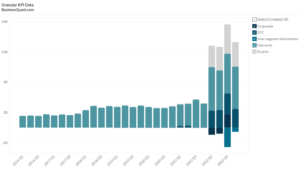

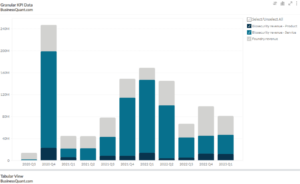

This statistic highlights Canopy’s Growth Average Selling Price, reported on a quarterly basis from Q1 2016 onwards.

Canopy Growth Corporation is a Canadian multi-brand cannabis company. It was formerly called Tweed Marijuana Inc. The company is engaged in the business of producing and selling legal marijuana in the Canadian medical market. It is also trying to produce and sell in the recreational market in Canada as well. Canopy is the world’s largest company based on market capitalization. They operate through their subsidiaries Tweed Inc, Bedrocan Canada Inc, Tweed Farms Inc, and Mettrum Health Corp. Their major brands are Tweed and Bedrocan. Their products include edibles, beverages, vapes, dried flower, oils and concentrates, soft gel capsules and hemp. Tweed is a licensed producer of medical marijuana. Tweed brand alone sells approximately 3,540 kilograms of medical marijuana per year. Bedrocan is a medical-grade cannabis. Bedrocan’s over 52,000 square feet production facility in Toronto, Ontario is licensed, and includes over 30 vegetative and growing rooms. Their primary competitors are Canndescent, CV Sciences, Cronos Group, Aurora, and Tilray.

Canopy’s Growth Average Selling Price

Canopy’s revenue increased to C$253.44 million in 2018 from C$77.95 million in the previous charting a growth of almost 225% from 2018.

The average selling price is the average price at which companies sell their products across markets. The type of product and it’s life cycle also affect a product’s average selling price. The average selling price is calculated by dividing the net sales with the number of units sold.

At the start of 2017 the ASP (average selling price) per gram for cannabis from Canopy was C$7.09, which dropped to C$7.01 in the second quarter and then increased to C$7.36 in the third quarter and C$8.03 in the fourth quarter. By the start of 2018, the price had gone down to C$7.96 in the first quarter and then started increasing quarter on quarter to C$7.99 in the second quarter, C$8.30 in the third quarter and $8.43 by the end of the year. This increase in price continued into 2019 with the price going up to C$8.94 in the first quarter, and a whopping C$9.87 in the second quarter. After the unprecedented rise in the second quarter of 2019, the price fell down to 2017 numbers. The third quarter of 2019 saw the price go down to $7.33 and then C$7.49 in the last quarter. The price then went up to C$7.56 in the first quarter of 2020 and now seems to be coming down to C$7.50 in the second quarter.

Despite the increase in revenue Canopy is reporting a heavy loss year on year due to its increased costs. Canopy has been trying to lay off some employees to reduce their costs. The sale of marijuana has been increasing in Canada as well as international markets since many countries are now moving towards legalization of medical marijuana for starters. 2020 has seen the demand for medical marijuana to increase exponentially in international markets.

The canopy growth is looking to tap the opportunities for technological advancements in cultivation methods in the coming years. We can only hope that the legalization of medical-grade marijuana in other countries might help canopy out of its current situation.

Did you like Canopy’s Growth Average Selling Price statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.