Ideating and generating the next big stock idea isn’t easy. It takes several hours of screening, studying, and analyzing countless companies to generate even one decent investment idea. But fret not — this ordeal isn’t as dreadful as it used to be. Thanks to recent innovations by a few stock research platforms, you can now easily generate investment ideas and screen thousands of stocks at the click of a button. Here’s a list of the best stock screeners and scanners for 2026 that both new and experienced investors will find useful.

Best Stock Screeners and Scanners For 2026:

- Business Quant

- Finbox

- GuruFocus

- Morningstar

- Yahoo! Finance

- YCharts

- Koyfin

- Stock Rover

- Stockopedia

-

Business Quant

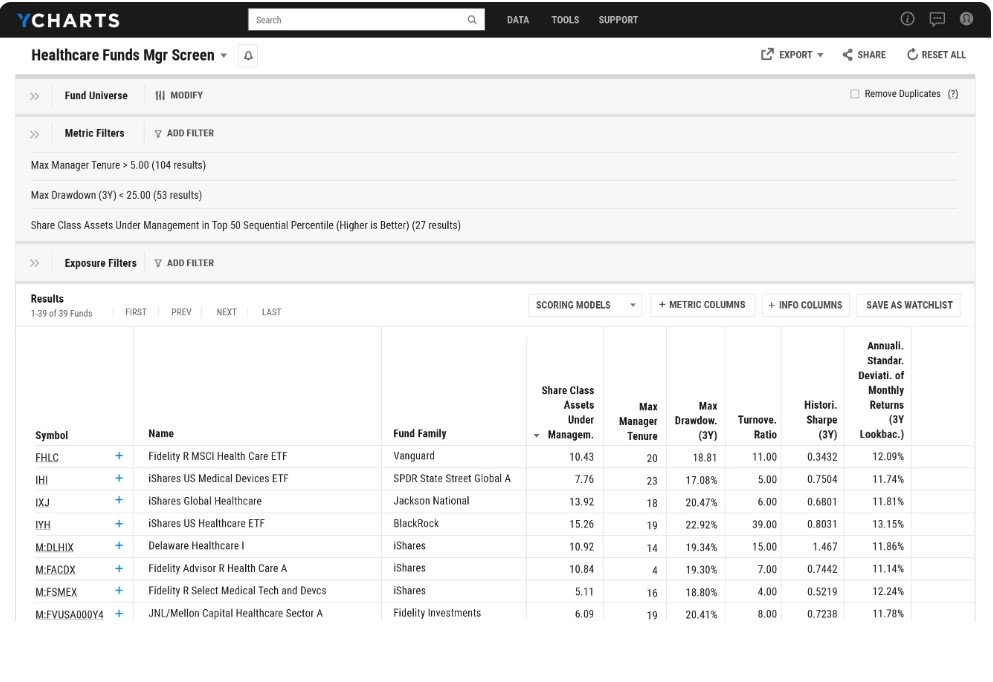

Business Quant is a leading investment research platform that provides powerful analytical tools with an easy-user interface, making researching stocks easy, convenient, and accessible to all. In addition to providing financial data, Business Quant distinguishes itself from the competition by also providing Company KPI data and Industry KPI data. This includes metrics such as financial breakdowns by segment, geographical regions, and product categories. You also get access to company-specific operating metrics such as Starbucks’ number of restaurant openings, Boeing’s aircraft deliveries, Tesla’s production by vehicle model, Netflix’s average revenue per user, and much more for thousands of stocks.

Regarding stock screening capabilities, Business Quant hosts a comprehensive stock screener. You can screen and filter thousands of stocks based on an extensive library of 500+ financial parameters spread across quarterly, annual, and TTM periods. You can also filter for industries and sectors to fine-tune your screening parameters. The stock screener is blazing fast, and the the results table is downloadable in Excel and CSV formats. So, in light of these flexible and powerful capabilities, I believe Business Quant is one of the best stock screeners for both seasoned and new investors.

Here’s a quick recap of features that users can access on Business Quant:

- Company KPI data,

- Industry KPI data,

- Economic data,

- Industry financials,

- Financial statements,

- Stock warnings,

- Stock ratings,

- Stock screener,

- Compare stocks,

- Timeseries analysis,

- Advanced charting tools,

- Institutional ownership data,

- Insider trading data,

- SEC filings,

- 200+ financial items and ratios,

- Download data in .csv/.xlsx formats

Pricing plans:

- Basic plan is Free

- Pro plan costs $19/month

Who is it ideal for: New and Experienced investors

-

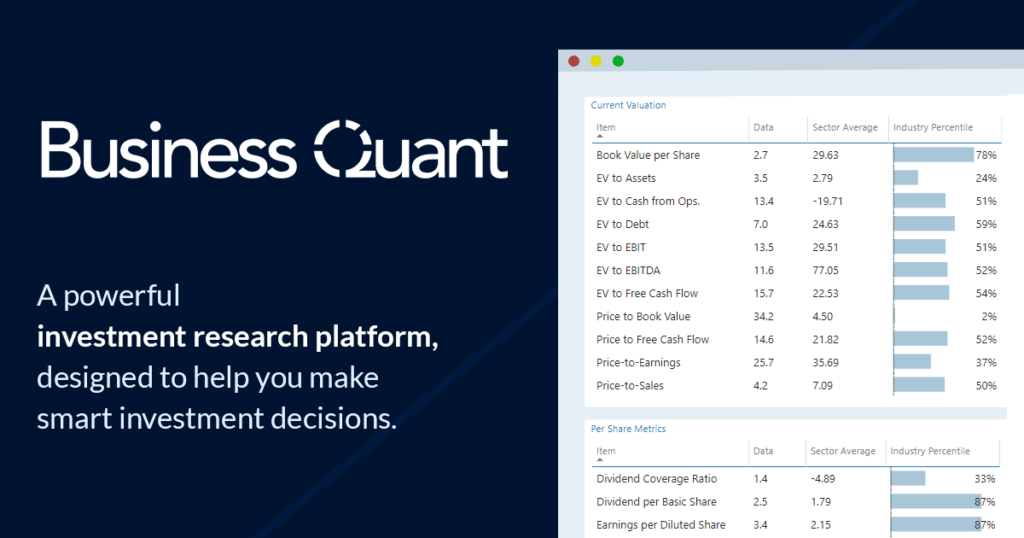

Finbox

Finbox is another financial analysis and research platform that provides a comprehensive set of analytical tools. Its feature set includes financial modeling capabilities geared toward experienced investors. So, I feel that new investors may be unable to utilize Finbox to its full potential. But apart from that, Finbox licenses its data directly from S&P Global Market Intelligence, which is considered to be the gold standard in fundamentals and forecast data.

Its stock screening capabilities are quite comprehensive as well. Like it was the case with Business Quant, Finbox also allows its users to freely filter stocks based on any combination of metrics and export the results table for further analysis in your favorite spreadsheet tool (MS Excel, Google Docs, etc.).

But apart from the stock screener, some of the other key features included with Finbox are:

- Charting tools,

- Financial modeling,

- Portfolio tracker,

- News feed,

- Financial modeling,

- Data export,

- Analyst forecasts,

- Price targets

Pricing:

- Starter plan that costs $19/month. Users cannot download data in this plan, and access is limited to just US companies,

- Executive plan costs $39/month. It unlocks data downloading along with access to US and Europe data,

- Professional plan costs $199/month. It unlocks data access to 6 global regions.

Who is it ideal for: Experienced investors

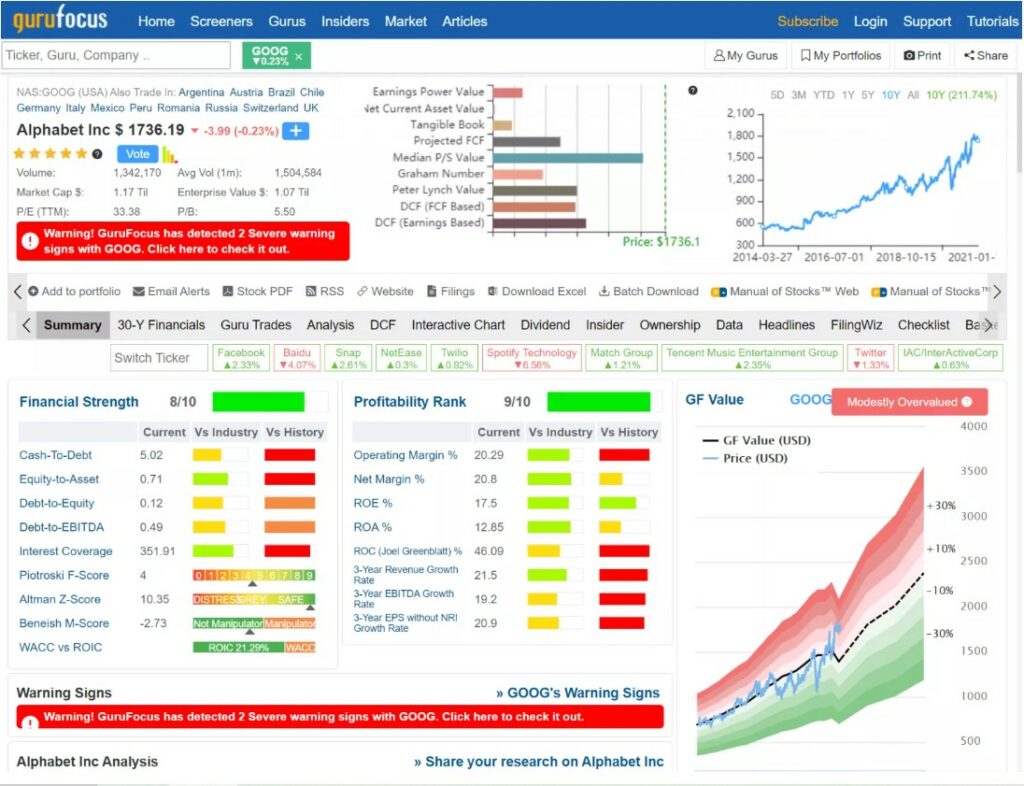

- GuruFocus

GuruFocus has been a leading investment research platform since its inception in 2004. It initially offered institutional ownership data and allowed investors to track holdings of renowned investors and fund managers in the US (like Warren Buffett, Bill Ackman, etc.). However, they gradually expanded their product suite and ventured into other geographical markets, becoming a well-rounded tool for researching stocks.

Regarding stock screening capabilities, GuruFocus allows users to filter stocks based on 99 parameters at the time of this writing.

Other than the stock screener, GuruFocus also provides features like:

- Analyst forecasts,

- International data,

- ETFs and mutual funds data,

- Portfolio tracker,

- Charting tools,

- SEC filings

Pricing:

- Premium plan costs $449/year

- Premium plus plan costs $1,348/year

- Professional plan costs $2,398/year

Who is it ideal for: Experienced investors

- Morningstar

Morningstar is another leading provider of investment tools and data. The company was founded in 1984 and is well-reputed amongst seasoned investors. The platform and the company offer various products and services, spanning investment research, stock ratings, portfolio management tools, fundamental data on stocks, mutual funds, and other investment vehicles. The company is also known for its proprietary Morningstar Rating system, which used to be unique and one-of-a-kind till a few years ago.

Regarding their stock screening capabilities, Morningstar’s stock screener seems to be relatively constrained with just 18 filtering criteria. In contrast, Business Quant and Finbox offer as many as 600 and 99 filtering criteria, respectively.

But having said that, Morningstar website still offers a bunch of other features, such as:

- Financial statements,

- Morningstar ratings,

- Portfolio tracker,

- Watchlists,

- Insider & institutional ownership data,

- Data export,

- ETFs and mutual funds data,

- Price targets and forecasts.

The pricing of this platform is given below:

Pricing: $249/year

Who is it ideal for: New and Seasoned investors

- Yahoo! Finance

Yahoo! Finance is perhaps the most popular research platform on our list. Yahoo! was founded in 1994 as a web directory and search engine but has since spun off its financial platform as Yahoo! Finance. Over the years, it has become a reputable and reliable source for financial news, real-time price quotes, and financial data. The platform is accessible both by mobile and desktop devices and is used by millions of users every day across the globe.

Regarding screening capabilities, Yahoo! Finance’s stock screener is free for users. However, the thing to note here is that its stock screener has just 89 filtering criteria without the ability to export data in Excel or CSV formats. These limitations might work for light users, but they could limit idea generation for serious investors who want ample flexibility in their screening parameters.

Apart from the stock screener, Yahoo! Finance offers other features such as:

- Charting tools,

- Financial statements,

- Stock insights,

- Financial news,

- Insider and institutional ownership data,

- Analyst forecasts,

- Watchlists,

- International fundamental data.

Pricing:

- Yahoo! Finance Lite is priced at $250/year

- Yahoo! Finance Essential is priced at $350/year.

Who is it ideal for: New investors

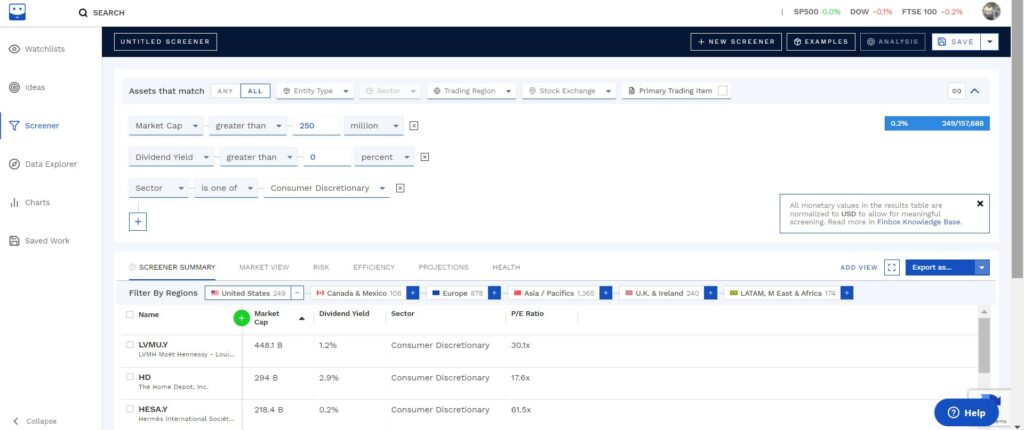

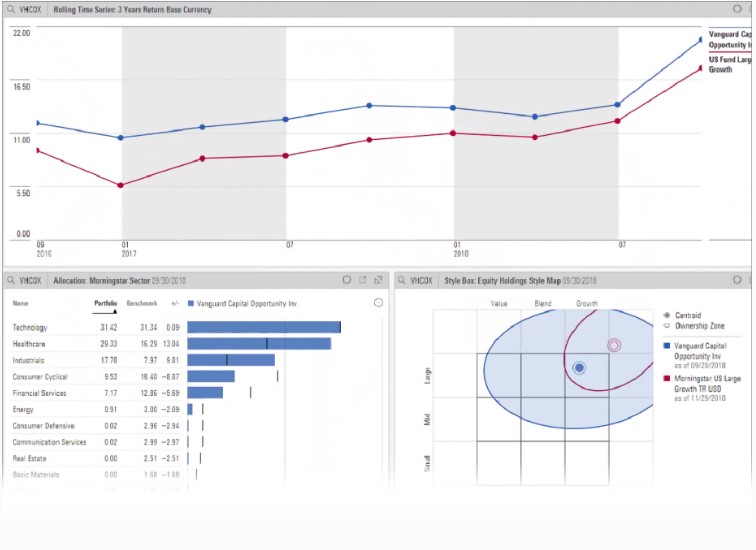

- YCharts

YCharts is an enterprise-grade financial research platform that provides investors with a wide range of data and analysis tools for stocks and funds. It was founded in 2009 and has been competing with high-end research terminals like Bloomberg and Reuters ever since. Ycharts was subsequently acquired by a PE firm in 2020 for an undisclosed amount.

Its stock screener is dynamic and allows users to screen for stocks based on any combination of metrics and ratios. Its stock screener notifies users with alerts if a particular criterion is met during a trading day. This makes Ycharts a well-deserving platform in our list of best stock screeners for 2026.

Besides the stock screener, YCharts also provides some other features, such as:

- Advanced charting tools,

- Financial statements,

- Portfolio tracker and watchlist,

- Financial modeling tools,

- International data,

- Analyst forecasts,

- Data export,

- Excel plugin

Pricing

- Basic plan costs $199/month (billed annually) and includes access to features such as customizable dashboards, charting tools, and up to 5 years of historical data,

- Professional plan costs $299/month (billed annually) and includes all the features of the Basic plan, as well as access to advanced analytics, portfolio monitoring tools, and 10 years’ worth of historical data,

- Premium plan costs $499 per month (billed annually) and includes all the features of the Professional plan, as well as access to additional data sets and custom data exports.

Who is it for: Experienced investors

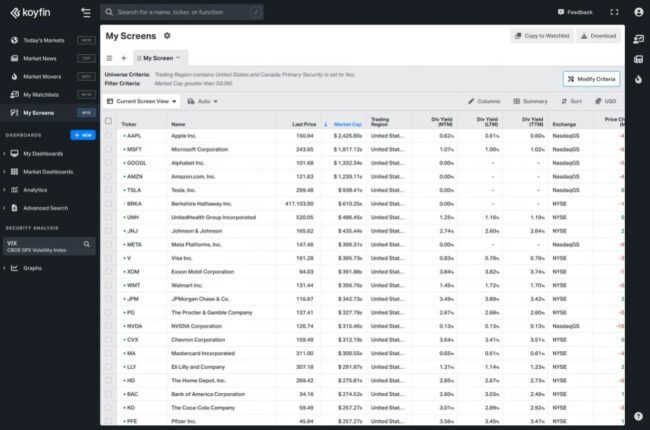

- Koyfin

Koyfin is another stock research platform that has been offering a myriad of analytical tools since its founding in 2016. It used to be entirely free initially, but they’ve recently changed their subscription plans, and it’s no longer free. The website has several tools that are well-suited for experienced and professional investors, such as real-time streaming quotes, data on multiple asset classes, and custom views.

Regarding the stock screener, Koyfin allows users to filter stocks based on any criteria. Unlike Yahoo! Finance, stock screeners from Koyfin and Business Quant are flexible and are used to filter stocks based on any combination of metrics.

The company provides several other features also, such as:

- Charting tools,

- SEC filings,

- Portfolio tracker,

- Watchlist,

- News feed,

- International data,

- Economic data,

- Data export,

- Mutual fund and ETF pricing quotes.

Pricing Plans:

The company has 3 straightforward pricing plans.

- Basic plan costs $25/month, but it doesn’t allow users to download data,

- Plus plan costs $45/month, which allows users to download data,

- Pro plan costs $100/month and unlocks custom dashboards, mutual fund data, and priority support.

Who is it ideal for: Experienced investors

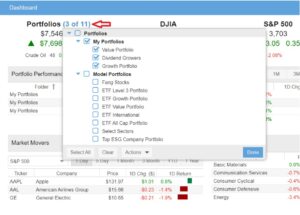

- Stock Rover

Stock Rover is another investment research platform that provides investors with a comprehensive suite of data and analysis tools. The platform was founded in 2008 and is one of the oldest websites on our list. The platform is geared toward fundamental investors, and it offers a range of tools to determine valuations, analyze company financials, and do thorough technical analysis on thousands of stocks.

Their stock screener is quite flexible. Like Business Quant and Koyfin, Stock Rover also allows users to screen for any combination of financial items, ratios and business metrics. In addition, it also allows users to enter their mathematical equations in the stock screener, which seems useful for sophisticated investors. This makes Stock Rover a great addition to our list of best stock screeners for 2026.

Besides, Stock Rover’s research platform offers a range of other features, such as:

- Charting tools

- Peer comparison,

- Financial statements,

- SEC filings,

- Stock ratings,

- Technical analysis tools

- Portfolio tracker,

- Watchlist,

- News Feed,

- Data export,

- Analyst forecasts

- ETFs and Mutual funds data.

Stock Rover has 3 pricing plans:

- Essentials plan costs $7.99/month, but it does not allow users to download data,

- Premium plan costs $17.99/month which allows users to download data,

- Premium Plus plan costs $27.99/month.

Who is it ideal for: Experienced investors

- Stockopedia

Stockopedia was launched in 2009 and is headquartered in the UK. The platform offers several tools to simplify stock research for individual investors. The website offers fundamental data across different markets, albeit for a marked premium over its entry-level plans.

As far as its stock screener is concerned, Stockopedia allows users to filter on any combination of metrics. Its filters are not locked, like they’re in Yahoo! Finance, and users have full flexibility on how to filter. This dynamism aligns with how stock screeners have been built at Business Quant, Ycharts, Koyfin, and other research platforms.

In addition to the stock screener, Stockopedia also hosts features such as:

- Guru screens

- Charts and technical analysis,

- Stock ranks and ratings

- Stock reports,

- Folios (portfolio & watchlist)

- Financial modeling tools

Pricing:

As of this writing, Stockopedia does not offer a Free Plan. It offers a 15-day trial of its paid plans. Also, its pricing plans differ slightly from others and vary by region. For instance, Stockopedia breaks down its pricing as follows:

- Data coverage on US stocks costs $50/month

- Data coverage on UK stocks costs $35/month,

- Data coverage on Indian stocks costs $30/month,

- Data coverage on Canadian stocks costs $40/month,

- Data coverage on European stocks costs $70/month,

- Data coverage on Developed Asian stocks costs $70/month

Who is it ideal for: Experienced investors

And that wraps up our list of best stock screeners and scanners for 2026.

Conclusion

As we saw in this article, different research platforms offer different functionalities at different prices. There isn’t a one-size-fits-all platform, and users must determine which research platform offers the best stock screener that meets their needs. But having said that, Business Quant offers company KPI and industry KPI data that is unique and unlikely to be found on other research platforms. Business Quant also hosts several powerful features, a comprehensive stock screener and many other tools to conduct thorough stock analysis without breaking the bank. So, you might want to check out Business Quant. But apart from that, we hope this article was helpful and wish you luck! Happy Investing!

(Image credits: Image by rawpixel.com on Freepik)