Aphria’s Revenue and Production Costs (2017-2021)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

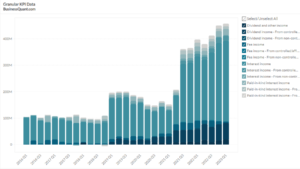

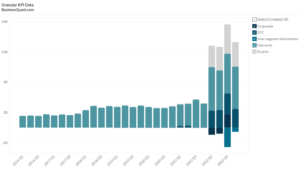

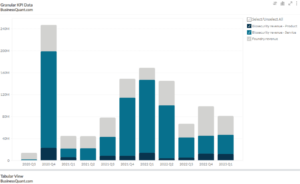

This statistic highlights Aphria’s Revenue and Production Costs, reported on a quarterly basis from Q3 2017 onwards.

Aphria Inc. is a cannabis company based in Canada. It has a market capitalization of $1.2 billion which makes it one of the largest cannabis companies in the world. It operates a 1,100,000 sq. ft greenhouse in Quebec called Aphria One. The greenhouse is capable of producing more than 100,000 kgs of marijuana per year. They also own brands like Broken Coast Cannabis, Riffe, and Good Supply. Broken Coast Cannabis is its major brand and is licensed to produce around 4,500 kgs of marijuana per year.

The company’s production costs as of the third and fourth quarters of 2017 were $1.30 million and $547,000 respectively. In 2018 the production costs increased to $1.35 million in the first quarter, $2.75 million in the second quarter, $2.36 million in the third quarter and $2.25 million by the end of the fourth quarter. Production costs increased further in 2019 to $4.83 million in the first quarter, $9.97 million in the second quarter, $10.18 million in the third quarter, and $13.33 million by the end of the year. Production costs went up to $15.45 million in the first quarter of 2020, $13.89 million in the second quarter, and are expected to reach $16.71 million in the third quarter of 2020.

Aphria’s revenue was $5.12 million in the third quarter of 2017 and $5.72 million in the fourth quarter. Revenue started to increase in 2018 and went up to $6.12 million in the first quarter, $8.50 million in the second quarter, $10.27 million in the third quarter, and $12.03 million by the end of the last quarter. Revenue continued to increase into 2019 and grew to $13.29 million in the first quarter, $21.67 million in the second quarter, $73.58 million in the third quarter, and $128.57 million by the end of the year. Revenue in 2020 was $126.11 million in the first quarter, $120.60 million in the third quarter, and is expected to go up to $144.24 million by the end of the third quarter.

As the revenue increases the company will have to entail more costs to keep up with the sales. Fortunately for Aphria, the growth in revenue is much greater than the growth in production costs. Aphria’s production cost has grown from $1.3 million in the third quarter of 2017 to an estimated 16.71 million in the third quarter of 2020 and the revenue has grown from $5.12 million in the third quarter of 2017 to an estimated $144.24 million in the third quarter of 2020. The company has come a long way since its incorporation.

The cannabis industry still has a lot of room to grow. The legalization of marijuana in Canada gave a huge boost to the cannabis companies based there. Since then the revenue figures for cannabis companies, in general, have been growing. Many countries are now in talks to legalize marijuana, which if agreed can be a big breakthrough in the marijuana market. Already established players like Aphria can expand their operations to many more countries outside Canada with greater ease than new entrants.

Did you like Aphria’s Revenue and Production Costs statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.