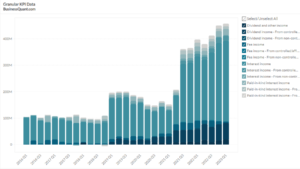

Antero Midstream’s Revenue Breakdown by Segment (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

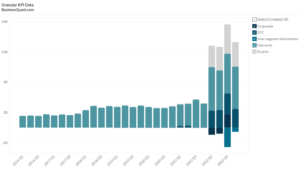

This statistic highlights Antero Midstream’s Revenue by Segment, split across Gathering and Processing, Water handling, and Water handling–third party, reported on a quarterly basis from Q1 2016 onwards.

Antero Midstream Corporation was established by Antero Resources Corporation to provide a growing herbal fuel line and NGL manufacturing within the Appalachian Basin.

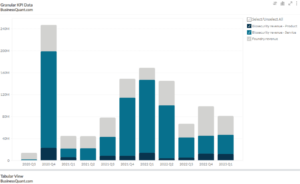

Antero Midstream Corporation’s Revenue by Segment

| Segment | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Gathering and Processing | $190.21 | $192.67 | $188.72 | 77.83% |

| Water handling | $61.00 | $57.72 | $53.51 | 22.07% |

| Water handling–third party | $0 | $0.07 | $0.25 | 0.10% |

| Total | $251.22 | $250.46 | $242.47 | 100.00% |

(All figures in millions, except percentages)

There are two reportable segments of the company: Gathering & Processing, and Water handling. Antero Midstream Corporation’s revenue decreased from $251.22 million in Q3 2020 to $242.47 million in Q3 2021, declining by approximately 4% on a year-on-year basis. Further, there was also a decline of 3.2% on a quarter-on-quarter basis, from $250.46 million in Q2 2021 to $242.47 million in Q3 2021.

Antero Midstream corporation’s total revenue is further bifurcated into the two following segments:

Gathering & Processing

The gathering and processing segment includes a network of gathering pipelines and compressor stations that collect and process gross production from Antero Resources’ wells, as well as equity in earnings.

The Gathering and Processing segment is the major contributor to the revenue. It alone contributed 78% to the total revenue generated by the company in Q3 2021. The revenue from this segment has decreased from $190 million in Q3 2020 to $188.72 million in Q3 2021, decreasing by almost 1% on a year-on-year basis. On a quarter-on-quarter basis, the revenue decreased from $192 million in Q2 2021 to $188.72 million in Q3 2021, marking a decline of 2%. This decrease was caused by the negative impact on volumes due to downtime at the Sherwood and Hopedale processing and fractionation facilities.

Water handling

The Company’s water managing section consists of unbiased structures that supply water, which include the Ohio River, neighbourhood reservoirs and numerous local waterways. These structures are also utilised to transport flow back and produced water. The water handling systems consist of permanently buried pipelines, surface pipelines and water storage facilities, as well as pumping stations, blending facilities and impoundments to transport water throughout the structures used to supply water to Antero Resources’ nicely completions..

The Water Handling segment of the company contributes 22.07% to the total revenue generated in Q3 2021. The revenue from this segment has been continuously declining over the last few quarters. Revenue from this segment decreased by 11.5% in Q3 2021 on a year-on-year basis, from $61 million in Q3 2020 to $53.51 million in Q3 2021. The revenue decreased from $57.52 million in Q2 2021 to $53.51 million in Q3 2021, marking a downfall of almost 7% on a quarter-on-quarter basis.

Water Handling-Third Party

The Water Handling-third party segment of the company contributes a mere 0.10% to the total revenue generated in Q3 2021. The revenue from this segment has been rising with each passing quarter. Revenue from this segment increased from $0 million in Q3 2020 to $0.25 million in Q3 2021 on a year-on-year basis. The revenue increased from $0.07 million in Q2 2021 to $0.25 million in Q3 2021, marking a massive increment of almost 257.14% on a quarter-on-quarter basis.

About Antero Midstream Corporation

The corporation, headquartered in Denver, Colorado, is focused on creating value through developing midstream infrastructure in two of the premier North American Shale plays, the Marcellus and Utica Shales. Antero is the most integrated NGL and natural gas business in the U.S because of its market-leading firm transportation portfolio and midstream ownership through Antero Midstream. Some of its competitors are Southcross Energy, Plains Midstream and Tallgrass energy.

Did you like Antero Midstream’s Revenue by Segment statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.