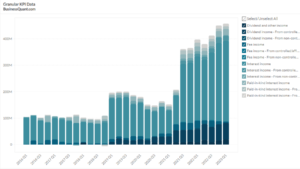

AMD’s Revenue by Segment (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

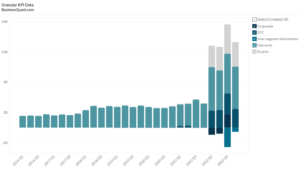

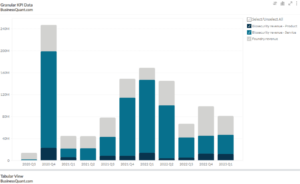

This statistic highlights AMD’s Revenue by Segment on a quarterly basis from Q1 2016 onwards, split between Computing & Graphics, and Enterprise, Embedded & Semi-Custom.

AMD Inc. is an American multinational semiconductor company. They produce computer processors and related technologies for business and consumer products. It is headquartered in Santa Clara, California.

AMD’s Revenue by Segment

| Segment | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Revenue Share in Q1 2021 |

| Computing & Graphics | $1.44 | $1.37 | $1.67 | $1.96 | $2.10 | 61% |

| Enterprise, Embedded & Semi-Custom | $0.35 | $0.56. | $1.13 | $1.28 | $1.35 | 39% |

| Total | $1.79 | $1.93 | $2.80 | $3.24 | $3.45 | 100% |

(All figures in billions, except percentages)

Computing and Graphics

This segment addresses the need for computational and visual data processing in computing devices that include personal computers, laptops/notebooks, and workstations. The company serves this segment with its CPU, GPU, APU, system-on-chip and chipset product offerings. The Computing and Graphics segment is the major source of revenue for AMD Inc during Q1 2021 and contributes $2.10 billion, making up about 61% of the total earnings. The revenue during this period saw a growth of 7% as compared to Q4 2020 when $1.96 billion were earned.

Enterprise, Embedded and Semi-Custom

The Enterprise, Embedded and Semi-Custom segment address the need for computational and visual data processing in the Server, Embedded computing device, and custom-designed computing device markets. They serve this segment with their customized-designed system-on-chips products. AMD Inc earned $1.35 billion from Enterprise, Embedded and Semi-Custom segment during Q1 2021, which was a 5% increase when compared to Q4 2020 when $1.28 billion were earned. Enterprise, Embedded and Semi-Custom segment contribute 39% of the total revenue of the company during Q1 2021.

Despite the COVID-19 pandemic, the total revenue of AMD has increased from $1.79 billion to $3.45 billion, between Q1 2020 and Q1 2021, which was a 92% increase. Further analysis reveals that revenue from the Computing and Graphics segment has grown at a rate of 46%, while that from the Enterprise, Embedded and Semi-Custom segment has grown at a rate of 286% during this period.

While the revenue from Enterprise, Embedded and Semi-Custom segment has shown a continuous growth between Q1 2020 and Q1 2021, the revenue from Computing and Graphics markets while generally showing a growing trend, has had a dip during Q2 2020.

The COVID-19 pandemic has forced companies and educational institutions to break away from their traditional methods of functioning and adopt the work-from-home model. This has led to an increase in demand for Laptops and PCs, which has, in turn, led to an increase in demand for components used in consumer electronics goods. It appears that AMD has benefitted from this development.

The total revenue of AMD is expected to increase further with the introduction of the Radeon RX 6000M series mobile graphics which comes with several features for gamers including Infinity Edge, Smart Access memory, and SmartShift technology. HP, Asus, MSI and Lenovo will bring the new AMD Radeon RX 6000M GPU to their new powerful gaming laptops. AMD has also announced that it will be launching products such as RX 6700 XT graphics card, Radeon RX 6900 XT, and Radeon RX 6800 Series in the coming months.

Company Overview

Advanced Micro Devices (AMD) is a public limited company founded in 2009. As of 2020, the number of employees of the company worldwide was 12,600. AMD Inc’s key managerial persons are John Edward (Chairman), Lisa Su(President and CEO) and Mark Papermaster (CTO). The stocks of Advanced Micro Devices are listed on the New York Stock Exchange under the ticker symbol “AMD”. They deal in products such as Central processing units, Microprocessors, Graphics processing units, TV accessories, Drivers, Solid-state drives, Embedded processors, Network interface controllers, Motherboard chipsets, and Systems-on-chip (SoCs). The competitors of AMD are Intel, NVIDIA, Qualcomm, Synopsys, and Marvell Technology.

In November 2009, Intel agreed to pay Advanced Micro Devices Inc $1.25bn and renew a five-year patent cross-licensing agreement as part of a deal to settle all outstanding legal disputes between them. AMD was rated as the fifth most progressive of 24 consumer electronics companies by the Non-Profit Organisation known as the Enough Project in 2020.

Did you like AMD’s Revenue by Segment statistic?

Access thousands of more such key performance indicator data points, on listed companies, with Business Quant.

You can also get started for free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.