On May 8, 2020 Canadian gold miner Agnico Eagle mines (NYSE:AEM) promised solid performance in the coming future. Initially, Agnico Eagle mines failed to satisfy its analysts when they reported their quarterly results of 2020.Apart from revenue, the company failed to meet analysts expectations in all other aspects. Agnico Eagle mine was not resistant to the pandemic, although it was obligated to close functioning of many of its mines due to the lockdown enforced by government. To overcome the unavoidable recession following the corona virus pandemic, governments from all over the world continue to print money which makes the long term future of Agnico Eagle very promising. Agnico Eagle mines is definitely an attractive stock for the investors right now but before jumping onto any type of conclusions, let’s take a look at Q1 2020 results of Agnico Eagles mines:

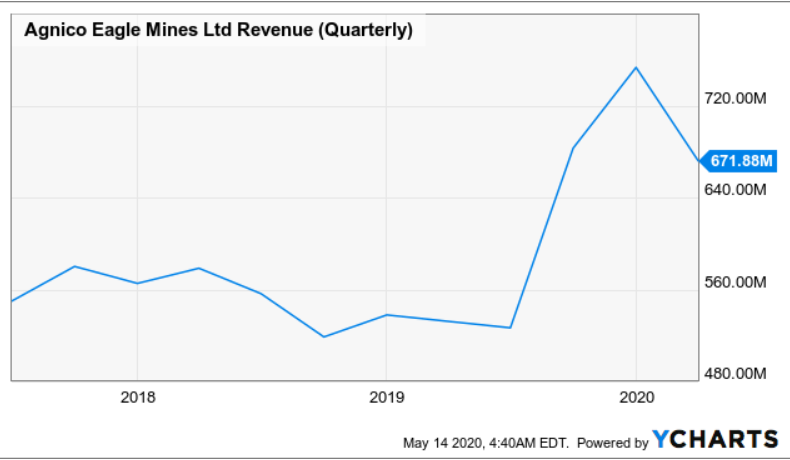

Total revenue reported by Agnico Eagle mines was $671.878 million which implies an increase of 26.24% over the earnings reported in the previous year. In comparison to the previous quarter’s 398,217 ounces of gold, Agnico Eagle mines managed to produce 411,366 ounces in the recent quarter. Agnico Eagle suffered a total loss of $21.565 in Q1 2020.

By a large amount of printing done by the governments and central banks, Agnico Eagle has surely benefitted from this in its first quarter. This can be observed by the rise in the revenue which the company generated from its mining operations. $1579 per ounce of gold was received by Agnico Eagle in comparison to $1303 per ounce in the previous year, which is the reason for the positive result reported by the company. Just like any other gold mines, Agnico also produces other metals, but the majority of its revenue is generated from gold. Approx 97% of its revenue is from gold while 3% is generated from other metals like silver, the reason being that prices of silver are considerably lower than that of gold prices.

Some reasons indicate that there would be expected growth in gold. The biggest reason, as mentioned earlier, is the money being printed by the United States government and the Federal Reserve to fight against the pandemic. Earlier in March, Agnico Eagles were restrained from continuing their operations at all its 5 mines situated in Canada due to the pandemic but lately, Agnico Eagles have begun to bring those mines back on track and hopefully, if there are no more further lockdowns imposed by the government it will be advantageous for the company as it will help it to produce much better results in the second half than the first half of the year.

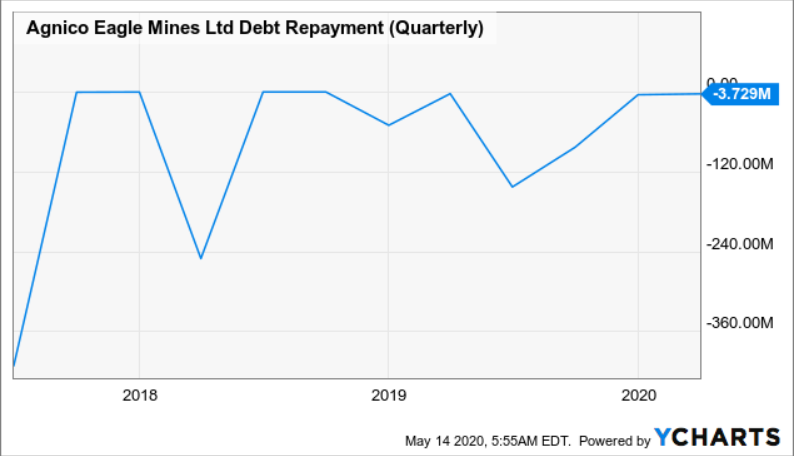

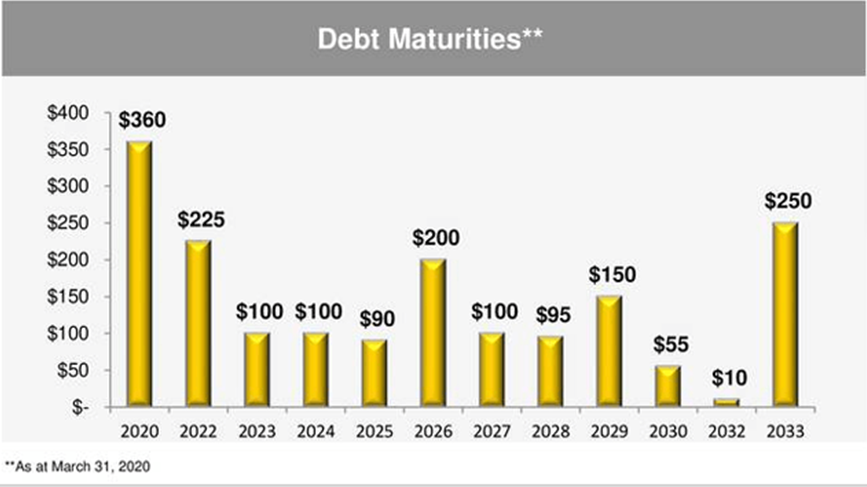

The Gold mining business is capital-intensive. Instead of raising it through equity and diluting the control of stakeholders, Agnico mines prefer to raise funds through debt resulting in a high amount of debt. This could be riskier for the company if there is a decline in gold prices or the occurrence of any other situation which could negatively impact its financials, for example, the current COVID-19 crisis.

Looking at the debt maturities and repayments information disclosed by the company, it can be observed that the company is stable enough to repay its debt on time, which in turn reduces the risk profile for investors.

It appeared to be a solid quarter for Agnico Eagles that would probably improve over the rest of the year. However, the current scenario for gold prices is pretty good and doesn’t seem to change any time soon. Also, it doesn’t look like the Federal Reserve will stop printing new money which is again beneficial for gold prices and other hard assets.