Writing Research Articles

Welcome to Business Quant’s research report writing guide.

We hope this guide helps you in becoming better at writing financial content, especially research articles and research reports.

Our goals:

- Write one research article every day, submissions by 7pm every day;

- Each article should be 800-words plus;

- Content should not be verbose (click here for the meaning);

- Write original analysis;

- Free of plagiarism. Simply copy pasting content and calling it your own, can land you in trouble.

Our Template

The playlist should give you an overview about how the financial content/research report writing usually goes.

We’ll focus on a specific article template in the first few weeks, which is divided into three parts:

- What Happened?

- So What?

- Now What?

Let’s break this down a bit and address each part, step by step.

- What Happened?:

What exactly happened in the market that readers should know about? This paragraph should be two or three sentences long at max and it should talk about a new development in the market. It also needs to briefly tell readers within one sentence, how this development impacts the company.

For example, if a company closed its stores, we could write “Shares of RH (NYSE: RH) were down on Tuesday, after the upscale home-furnishings retailer said that it will keep its stores closed indefinitely amid the ongoing coronavirus pandemic. This could have severe consequences for the company and its shareholders as it generates most of its revenues from brick and mortar stores.”

This way, we peaked the reader’s interest without revealing too many details. The opening was short and to the point. Now we can go on about explaining the news and how the news impacts the company, in the next section of this article.

- So What?:

Why should readers care? This section elaborates on the new development and explains how and why the development impacts the company.

Example: “RH had originally planned to keep its retail locations closed until March 27, and to pay its employees while they were closed. But that plan has had to change: CEO Gary Friedman said that the company’s stores will now be closed indefinitely, and that it will pay its store employees through April 3, but not beyond that.”

You can also use excerpts from official press releases (with hyperlinks taking us back to the source document) to provide clarity on what really happened.

Also, it’s important you use relevant charts from Business Quant, showcasing our platform. Every article must have between one to three charts from Business Quant. If the development impacts the industry, then you can mention the company’s competitors as well to expand on your discussion - Now What?:

This is the predictive bit. Keep it short and concise. Do you expect the current situation to keep on impacting the company, or do you expect the impact to fade away in some time. Also, what should investors do.Example, “For investors, here’s the takeaway: RH should have the cash and resources to get through this, and it might even be in position to make some acquisitions as competitors falter. But it’s going to be ugly for a while. “

Some pointers

- Use multiple charts to explain the impact of these developments on respective companies. Example, trade tariff war between US and China can wreak havoc on a company’s financials if it generates a significant portion of its revenues from China and exports to the US, and vice versa. Attaching the company’s revenue by region, or assets by region chart, might better explain the situation.

- No assumptions. Everything has to be fact-based or opinion. We won’t rely on “common sense.” Provide hyperlinks for all your excerpts, research and charts. Example, “Apple (NASDAQ: AAPL) outperformed the Street’s revenue estimates when it last reported earnings on April 30. Yet, in spite of this beat, analysts have lowered their revenue expectations.”

- If it’s your opinion, say it clearly. Don’t write it as “it’s common in this industry” or “it is believed.” Write it as “I believe Apple will start manufacturing potatoes if the economy doesn’t recover soon.

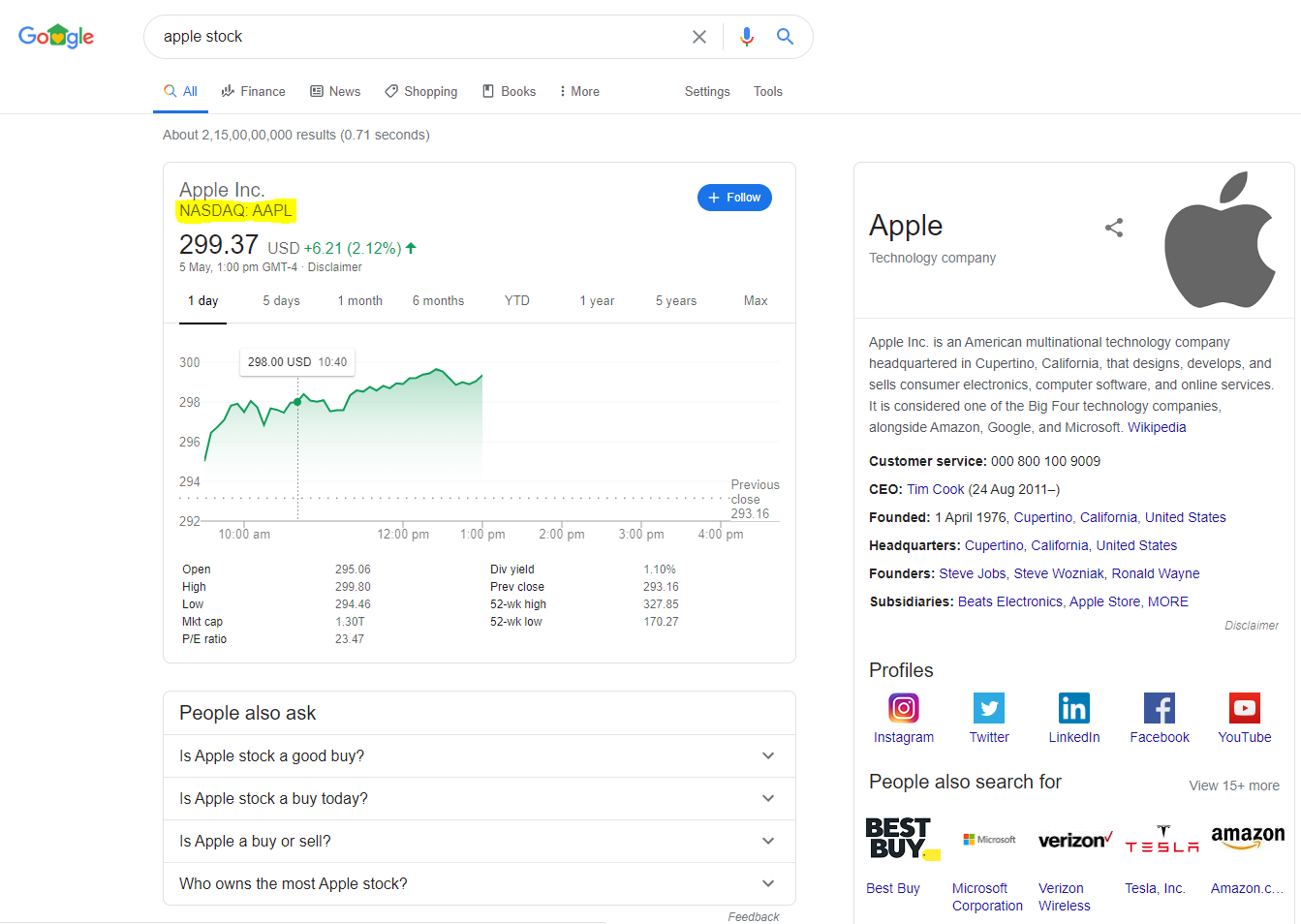

- Whenever mentioning a company for the first time, add its ticker tag with the format “(NYSE: GE)”. A practical example, “Apple (NASDAQ: AAPL) announced that it’s temporarily shutting down stores during the coronavirus outbreak. Now you can find the exact ticker tags by searching for “Apple stock”.

Some Examples

You may want to use Motley Fool’s articles as a template, while you get used to this style of writing.

Some of their articles fitting this theme:

Picking an Article Topic

- You can write on any recent development on any company that’s on the Granular Tracker (previously called as Fundamental Tracker).

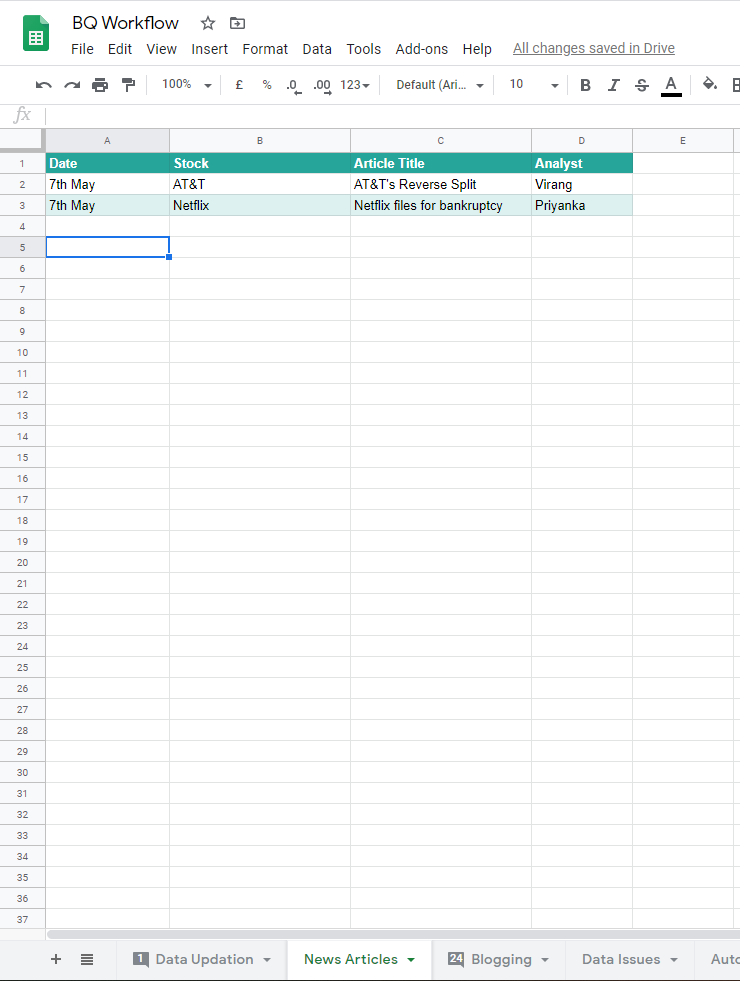

- When you pick an article topic, make sure to enter the idea on BQ Workflow -> News Articles, so that others don’t also write on the same topic. Ideally, we’ll take only one article per news item. Example, there won’t be two articles on Netflix’ bankruptcy. So, please make sure to visit the sheet before writing anything.

The only things you need to keep in mind, while picking an article topic, are:

- Is the news recent?

- Would you be able to quantify exactly how much of a financial impact will it have on the company?

Example: If Frontier Communications announced a change of CEO, we won’t be able to ascertain the financial impact.

However, if Frontier Communications announced the divestment of a revenue-generating asset, we can look at Fundamental Tracker and tell readers exactly how much revenue loss took place and how big of an asset was it compared to its overall assets.

Also, the news item should be at most 2 days old. Anything older will be considered stale and it won’t be fit for publication, regardless of how well you write it.

Accessing the Back End

- Make sure you registered on Business Quant.

- Login here and then try opening this link.

- If you get an error, contact Piyush.

- If you’re able to view the back-end, click on Posts -> Add Posts.

- While posting your article, select the category as “News”

- Lastly, you’d notice that there’s a box called Tags while posting your article (screenshot below). We have to enter:

Let us know if you have any doubts.

Good Luck!

Piyush Arora

Founder & CEO