XL Fleet’s Shipment Volume of Systems (2020-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

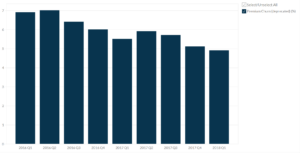

This statistic highlights XL Fleet’s Shipment Volume of Systems, reported on a quarterly basis from Q4 2020 onwards.

XL Fleet is a provider of fleet electrification solutions for commercial vehicles in North America, offering vehicle electrification systems (the “PowerDrive” business) and providing infrastructure solutions including energy efficiency and charging stations throughout the business. As of December 31, 2021, XL Fleet has sold over 4,450 electric powertrain systems driving over 181 million miles with over 245 fleet customers.

Meaning of Shipment Volume Systems

The term CBM is often heard when one is shipping goods by air, sea, or road from one country to another. CBM, which stands for “cubic meter”, is a widely used unit of measurement in transportation and determines the amount to be paid for cargo. Cubic meters of CBM is a measure of the amount of cargo. It determines the space that cargo occupies on a ship, plane, or truck, which determines transportation costs.

Length x Width x Height = CBM, this formula measures cargo volume in CBM (m³). A cubic volume of freight is usually required to get a price quote. CBMs (Cubic Meters) help you calculate the number of products that will fit in a CBM and shipping container. CBM is also important for requesting dimensional weights, billable weight calculations, freight class calculations, or freight quotes. This number is the basis for many calculations that determine the amount of shipping costs.

XL Fleet’s Shipment Volume of Systems

| Category | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 |

| Shipment Volume | 837 | 31 | 88 | 36 |

(all figures are in cubic metres)

It is not possible to draw any specific trend from the graph as there is an extreme rise in Q4 2020 followed by a major dip in Q1 2021. This is followed by extreme recovery in Q2 2021. In the latest quarter, there was again a major dip.

XL Fleet’s Shipment Volume of Systems witnessed a major decline from 837 cubic metres in Q4 2020 to 31 cubic metres in Q1 2021, accounting for the huge dip of 96.29%. It rose by 183.87%, from 31 cubic metres in Q1 2021 to 88 cubic metres in Q2 2021. This is followed by a major decline to 36 cubic metres in Q3 2021, from 88 cubic metres in Q2 2021, marking a decrease of 59.09% on a quarter-on-quarter basis. There isn’t enough data to analyse the year-on-year trend.

About XL Fleet

With more than a decade of experience since its founding in 2007, XL Fleet has established a niche for itself in the booming logistics industry, whether it’s air or road freight shipments. From sea transport to land transport, they are always ready to serve, pack, transport, send and deliver the goods on time. Air Cargo, Sea Cargo, World Wide Door to Door Service, Packing and Shifting, International Courier Service, Excess Baggage, Export Service, and Customs Clearance are among the services provided by XL Fleet. Excel Airways Group was the company’s first name. It was originally held by the Icelandic Flugfelagid Atlanta HF and was purchased by the Icelandic Avion Group in November 2004.

They became a provider of energy efficiency, renewable technologies, electric vehicle charging stations, and other energy solutions to consumers in the New England region after acquiring World Energy. They support organizations in all stages of the fleet vehicle electrification process by utilizing their comprehensive solutions in conjunction with project management and utility incentive and finance schemes. They offer full-service electric vehicle charger installations, which include assessing a location’s electrical infrastructure, designing the charging station layout, and installing the necessary equipment. Their conviction is that the availability of comprehensive electric car charging and infrastructure solutions is important to supporting their clients’ long-term fleet electrification aspirations, which will convert into growth prospects for the Company.

Did you like XL Fleet’s Shipment Volume of Systems statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.