Workhorse Group’s Revenue Breakdown (2017-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

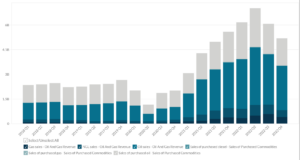

This statistic highlights Workhorse Group’s Revenue Breakdown, split across automotive, aviation and other verticals, reported on a quarterly basis from 2017 onwards.

Workhorse Group’s Revenue Breakdown

| Vertical | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Automotive | $560.33 | $1,120.00 | ($535.00) | 93% |

| Aviation | $0.00 | $0.00 | $0.00 | 0% |

| Other | $4.38 | $82.88 | ($41.60) | 7% |

| Total | $564.71 | $1,202.88 | ($576.60) | 100.00% |

(All figures in millions, except percentages, figures in () represent negative figures)

The total revenue of the Workhorse Group fell from $564.71 million to $(576.6) million, from Q3 2020 to Q3 2021, marking a significant fall of approximately 202%, in just a year. The revenue also fell by $1,779.5 million, leading to a 148% fall in revenue on a quarter-on-quarter basis, from $1,202.88 million in Q2 2021 to $(567.60) million in Q3 2021. On the contrary, the revenue grew by $681.82 million in Q2 2021, when compared to Q1 2021.

Workhorse Group’s revenue can be bifurcated into the following business verticals:

Automotive

The company is an Original Equipment Manufacturer or OEM. The products are sold to the customers via distributors like Hitachi, Pritchard, and Ryder. Ryder and Pritchard are both maintenance providers and give the operators access to maintenance facilities. It includes the sale of products like delivery trucks for commercial work and C-series electric delivery trucks. It is also one of the five participants in the “Next Generation Delivery Vehicle Project” of United States Postal Services.

This vertical had the highest share of 92.8% in the company’s total loss in Q3 2021. Revenue from automotive declined from $560.33 million in Q3 2020 to $(535) million in Q3 2021, leading to a 195% fall in revenue in just a year. Its revenue also fell by $1,655 million in Q3 2021, when compared to Q2 2021, and hence falling by 148% on a quarter-on-quarter basis.

Aviation

It includes the sale of drone systems manufactured by the company. The company is currently working on the FAA Type certification for its drone Horsefly UAS. This certification will differentiate Workhorse’s products from other drones in the market.

This segment had no share in Q3 2021’s loss but it had a 4.3% share in the company’s total revenue in Q1 2021. Also, there was no revenue in this vertical in 2021 except $22.40 million in Q1 2021.

Other

This vertical includes the after-sale services on vehicles with no warranty and some grant-related research work.

This vertical had a 7.2% share in the total loss made by the company in Q3 2021. Its revenue fell from $4.38 million to $(41.6) million, from Q3 2020 to Q3 2021, marking a fall of approximately 1050% in the revenue in a year. The revenue also decreased by $124.48 million in Q3 2021, when compared to Q2 2021, marking a 150% fall in revenue on a quarter-on-quarter basis.

About Workhorse Group

Workhorse is mainly a technology company that focuses on providing cost-effective as well as sustainable solutions to the commercial transportation sector. It is an American manufacturer that creates drone systems and electric delivery trucks. It uses innovative technology to optimize the way of operating these mechanisms. The company has various technologies like Metron, HorseFly, and in-house software development.

Metron is a remote, cloud-based management system that tracks the performance of all the deployed vehicles and even provides real-time solutions to fleet managers. In-house software development includes motor assemblies, software, and computers used for vehicle electrification. HorseFly is an all-electric drone system that is incorporated into trucks to deliver packages efficiently. It includes an aircraft, GCS, and all other handling systems for takeoff and landing. The company is last-mile delivery’s first purpose-built, electric mobility solution and is currently focusing on its C-series electric delivery trucks and overcoming its backlog. The common stock of the company is publicly traded on the NASDAQ under the symbol “WKHS”.

Did you like Workhorse Group’s Revenue Breakdown statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.