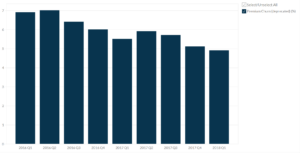

Spirit AeroSystems’ Shipset Deliveries (2016-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

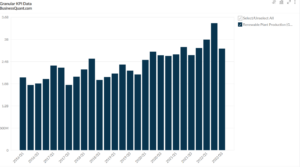

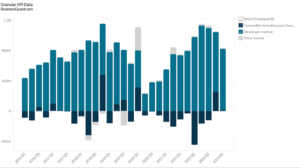

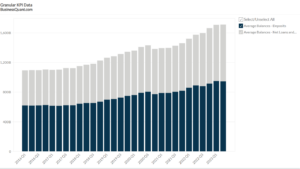

This statistic highlights Spirit AeroSystems’ Shipset Deliveries, split across A220, A320 Family, A330/340, A350 XWB, B737, B747, B767, B777, B787, and Business/Regional Jets, reported on a quarterly basis from Q1 2016 onwards.

Spirit AeroSystems is one of the largest manufacturers of aerostructures for premier aircraft in the world. The core products produced by the company includes pylons, nacelles, fuselages, and wing components.

Spirit AeroSystems’ Shipset Deliveries

| Shipset Deliveries | Q4 2020 | Q3 2021 | Q4 2021 | Contribution in Q4 2021 |

| A220 | 11 | 12 | 17 | 6.39 |

| A320 Family | 101 | 105 | 136 | 51.12 |

| A330/340 | 3 | 6 | 5 | 1.87 |

| A350 XWB | 11 | 9 | 10 | 3.75 |

| B737 | 19 | 47 | 51 | 18.17 |

| B747 | 2 | 1 | 2 | 0.75 |

| B767 | 8 | 8 | 7 | 2.63 |

| B777 | 9 | 7 | 5 | 1.87 |

| B787 | 20 | 5 | 6 | 2.25 |

| Business/Regional Jets | 47 | 50 | 27 | 10.35 |

| Total | 231 | 250 | 266 | 100% |

(All the figures are in absolute terms)

The total deliveries of shipset by the company rose from 231 deliveries in Q4 2020 to 266 deliveries in Q4 2021, depicting a yearly increase of 15.15%. The deliveries also increased by 6.4% on a quarter-on-quarter basis, increasing from 250 deliveries in Q3 2021 to 266 deliveries in Q4 2021.

Spirit Aerosystem’s Shipset Deliveries can be further bifurcated into the following:

A220

The deliveries of A220 has been continuously increasing. In Q4 2021, 6.39% of the total deliveries were of A220, amounting to 17 deliveries. On a year-on-year basis, the number of deliveries increased from 11 deliveries in Q4 2020 to 17 deliveries in Q4 2021, making a rise of 54.54%. When compared quarterly, the number of deliveries increased by 41.67%, as compared 12 deliveries in Q3 2021.

A320 Family

The deliveries of A320 Family has been continuously increasing. In Q4 2021, 51.12% of the total deliveries were of A320 Family, amounting to 136 deliveries. On a year-on-year basis, the number of deliveries increased from 101 deliveries in Q4 2020 to 136 deliveries in Q4 2021, making a rise of 34.65%. In Q3 2021, it reported 103 Shipset deliveries, showing a quarter-on-quarter growth of 29.52%.

A330/340

The deliveries of A330/340 has shown growth as well as decline. In Q4 2021, 1.87% of the total deliveries were of A330/340, amounting to 5 deliveries. On a year-on-year basis, the number of deliveries increased from 3 deliveries in Q4 2020 to 5 deliveries in Q4 2021, making a rise of 66.67%. In Q3 2021, it reported Shipset deliveries of 6, showing a quarter-on-quarter decline of 16.67%.

A350 XWB

The deliveries of A350 XWB has shown growth and decline. In Q4 2021, 3.75% of the total deliveries were of A350 XWB, amounting to 10 deliveries. On a year-on-year basis, the number of deliveries decreased from 11 deliveries in Q4 2020 to 10 deliveries in Q4 2021, making a decline of 90.90%. In Q3 2021, it reported Shipset deliveries of 9, showing a quarter-on-quarter growth of 11.11%.

B737

The deliveries of B737 has been continuously increasing. In Q4 2021, 18.17% of the total deliveries were of B737, amounting to 51 deliveries. On a year-on-year basis, the number of deliveries increased from 19 deliveries in Q4 2020 to 51 deliveries in Q4 2021, making a rise of 168.42%. In Q3 2021, it reported Shipset deliveries of 47, showing a quarter-on-quarter growth of 8.5%.

B747

In Q4 2021, 0.75% of the total deliveries were of B747, amounting to 2 deliveries. On a year-on-year basis, it didn’t show any growth as it recorded 2 deliveries in Q4 2020 and Q4 2021. In Q3 2021, it made 1 delivery and showed a quarter-on-quarter growth of 100%.

B767

In Q4 2021, 2.63% of the total deliveries were of B767, amounting to 7 deliveries. On a year-on-year basis, the number of deliveries decreased from 8 deliveries in Q4 2020 to 7 deliveries in Q4 2021, making a fall of 12.5%. In Q3 2021, it made 8 deliveries and showed a quarter-on-quarter fall of 12.5%.

B777

The deliveries of B777 has showed continuous decline. In Q4 2021, 1.87% of the total deliveries were of B777, amounting to 5 deliveries. On a year-on-year basis, the number of deliveries decreased from 9 deliveries in Q4 2020 to 5 deliveries in Q4 2021, making a decline of 44.44%. In Q3 2021, it reported Shipset deliveries of 7, showing a quarter-on-quarter decline of 28.57%.

B787

The deliveries of B787 has showed slow growth and drastic decline. In Q4 2021, 2.25% of the total deliveries were of B787, amounting to 6 deliveries. On a year-on-year basis, the number of deliveries decreased from 20 deliveries in Q4 2020 to 6 deliveries in Q4 2021, making a decline of 70%. In Q3 2021, it reported Shipset deliveries of 5, showing a quarter-on-quarter growth of 20%.

Business/Regional Jets

The deliveries of Business/Regional Jets has shown slow growth and drastic decline. In Q4 2021, 10.35% of the total deliveries were of Business/Regional Jets, amounting to 27 deliveries. On a year-on-year basis, the number of deliveries decreased from 47 deliveries in Q4 2020 to 27 deliveries in Q4 2021, making a decline of 42.25%. In Q3 2021, it reported Shipset deliveries of 50, showing a quarter-on-quarter fall of 46%.

About Spirit AeroSystems

The company is headquartered in Wichita, Kansas, United States, and also has facilities in the United Kingdom, France, Morocco, and Malaysia. It was founded in 2005 and its common stock is listed on the NYSE under the ticker symbol “SPR”. The main competitors of the company are Triumph Aerostructures- Vought Aircrafts, Leonardo, Kawasaki Heavy Industries, and Collins Aerospace.

Did you like Spirit AeroSystems’ Shipset Deliveries statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.