Ping Identity’s Revenue by Segment (2019-2022)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

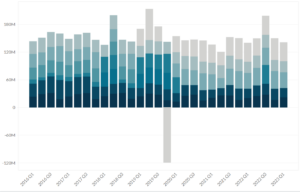

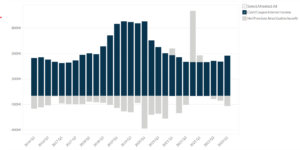

This statistic highlights Ping Identity’s Revenue by Segment, split across Subscription, and Professional services and other segments, reported on a quarterly basis from Q1 2019 onwards.

Ping Identity’s Revenue by Segment

| Revenue by Segment | Q2 2020 | Q1 2021 | Q2 2021 | Contribution in Q2 2021 |

| Subscription | $54.26 | $64.21 | $73.15 | 93% |

| Professional services and other | $4.71 | $4.72 | $5.75 | 7% |

(All figures are in millions, except percentages)

Ping Identity’s total revenue by segment increased from $58.98 million in Q2 2020 to $78.90 million in Q2 2021, marking a 33.77% growth on a year-on-year basis. It increased by 14.44% as compared to $68.94 million in Q1 2021, on a quarter-on-quarter basis.

Ping Identity’s Revenue is further bifurcated into the following segments:

Subscription segment

This revenue consists of subscription term-based license revenue for solutions deployed on-premise within the customer’s IT infrastructure or in a third-party cloud of the customer’s choice. It even includes support and maintenance revenue from such deployments, and SaaS subscriptions, which grant customers access to SaaS-based solutions.

Subscription payments are usually invoiced annually in advance. It is term-based licensing income that is recorded when ownership of the program is transferred, which occurs at delivery, or later when the license term begins. All support and maintenance revenue, as well as revenue from SaaS subscriptions, is recognized during the course of the appropriate agreement.

For the foreseeable future, they expect subscription term-based licensing to account for the majority of their revenue.

- The kind of new and renewed subscriptions (i.e., term-based or SaaS); and

- The duration of new and renewed term-based subscriptions are the primary determinants of period-over-period subscription revenue growth.

License revenue growth will increase as the percentage of subscription term-based licenses sold or renewed in a period, increases relative to the previous period, assuming all other factors remain constant. As a result of some of these deals, their revenue may fluctuate from period to period.

Long-term, paid-for licenses are expected to be more than half the proportion of long-term SaaS licenses sold or renewed in a given time. Multi-year, subscription term-based licenses will often result in larger revenue recognition upfront. As a result, revenue growth is expected to increase- but at a slower rate – over the longer term.

The major component, about 93% of the company’s total revenue was made up by the Subscription segment. Ping Identity’s revenue owing to the Subscription segment increased from $54.26 million in Q2 2020 to $73.15 million in Q2 2021, indicating a rise of 34.81% on a year-on-year basis.

Professional services and other segment

Fees from professional services supplied to customers and partners to configure and optimize the usage of their solutions, as well as training services connected to the configuration and operation of their solutions, make up the majority of professional services and other revenue.

These professional services are often billed on a time and materials basis, with invoices sent regularly and revenue recorded as services are completed. The revenue from their training services and sponsorship fees is recognized on the completion date of the services. They estimate professional services income as a percentage of total revenue to stay largely steady over time.

Ping Identity’s revenue from Professional services and other segments increased from $4.71 million in Q2 2020 to $5.75 million in Q2 2021, marking an increase of 22.08% on a year-on-year basis.

About the Company

Ping Identity Corporation is a software firm founded in 2002 by Andre Durand and Bryan Field-Elliot in the United States. It has development offices in Vancouver, British Columbia, Tel Aviv, Israel, Austin, Texas, Denver, Colorado, and Boston, Massachusetts, and is headquartered in Denver, Colorado. Ping also has offices in London, Paris, and Switzerland, as well as Asia-Pacific offices in Bangalore, Melbourne, and Tokyo.

Ping Identity’s software is similar to Microsoft and Okta’s identity management system tools, but with built-in access controls for web and mobile apps. This single sign-on (SSO) provides users with a single set of credentials to access company-related applications. Using open standards like SAML and OAuth, this is mostly done with identity services like Ping, Okta, and Microsoft Azure. As outlined in “Design Rationale Behind the Identity Metasystem Architecture,” these companies make up the “identity metasystem”.

Did you like Ping Identity’s Revenue by Segment statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.