Phillips 66’s Revenue by Product Category (2013-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

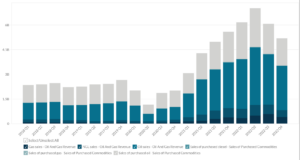

This statistic highlights Phillips 66’s Revenue by Product Category, split across Refined Products, Crude oil resales, NGL, Services and others, reported annually from 2013 onwards.

Phillips 66’s Revenue by Product category

| Product Category | 2018 | 2019 | 2020 | Contribution for 2020 |

| Refined Products | $87.97 | $87.90 | $49.77 | 77.62% |

| Crude oil resales | $16.42 | $14.13 | $9.11 | 14.21% |

| NGL | $6.16 | $4.81 | $4.08 | 6.36% |

| Services and others | $0.91 | $0.45 | $1.16 | 1.81% |

| Total | $111.46 | $107.29 | $64.12 | 100.00% |

(All figures in billions, except percentages)

Phillips 66’s total revenue has been decreasing since 2018. In the year 2019, total revenue decreased from $111.46 billion to $107.29 billion, making a decline of 3.74%. In the year 2020, the total revenue showed a massive fall by 40.24% from $107.29 billion in 2019 to $64.13 billion in 2020.

The plummeting revenues can be traced back to the COVID-19 pandemic. Travel and business restrictions to curb the pandemic resulted in low demand for refined petroleum products like gasoline and jet fuel. The prices of crude oil collapsed and the refining margins were significantly reduced.

Phillips 66’s products are classified into the following categories:

- Refined Petroleum Products

Refined petroleum products include products such as gasoline, diesel, and aviation fuels. Phillips 66 is engaged in the transportation, storage, terminaling, and refining of petroleum products. These products are then distributed to customers in different parts of the world through pipelines, cargos, barges, etc. The company owns and operates 39 refined petroleum product terminals. The company also purchases refined petroleum products from its joint venture WRB.

The revenue from the Refined Products category showed a small decrease in the year 2019 but a massive decline in the year 2020. In the year 2019, it reduced by 0.07% but in 2020 it declined by 43.38% indicating a reduction of $38.13 billion on a year-on-year basis. Price fluctuations, the introduction of renewable energy, and the ongoing pandemic are some of the reasons behind the falling revenue generation.

- Crude Oil resales

The operations involved in reselling crude oil are pretty much similar to that of refined petroleum products. Phillips 66 owns and operates 20 crude oil terminals. The company buys crude oil from WRB.

The revenue from this product category showed a downward trend for the past 2 years. In the year 2019, it reduced by around 14% is from $16.42 billion in 2018 to $14.13 billion in 2019. In 2020, it declined by $5.02 billion indicating a decline of 36% on a year-on-year basis. The Crude oil resales product category contributed to 14.21% of the total revenue in 2020.

- NGL

The company provides midstream services like transportation, storage, fractionation, processing, and selling of NGL. Phillips 66 owns and operates 5 NGL terminals. The company holds 11 NGL fractionation plants, along with natural gas and NGL storage facilities, NGL pipelines, marine vessels, and tankers. NGL is purchased from WRB, DCP Midstream, and CPChem; all of which are joint ventures of Phillips 66.

The revenue from the NGL product category has been declining since the year 2018. In the year 2019, it reduced by 22% from $6.16 billion in 2018 to $4.81 billion in 2019. In 2020, it declined by 15% on a year-on-year basis. The NGL product category contributed to 6.36% of the total revenue in 2020.

- Services and others

Phillips 66’s revenue earned by this category declined in the year 2019 by 51%. However, it increased by 158% in 2020. This product category contributed to 1.81% of the total revenue for 2020.

About the Company

Phillips 66 is headquartered in Houston, Texas, and was incorporated in Delaware in 2011. It provides midstream services for crude oil and NGL. Moreover, the company is involved in refining petroleum products. The company has ownership interests in multiple companies like WRB, DCP Midstream, and CPChem. CPChem manufactures and markets petrochemicals and plastics. The stock of Phillips 66 is traded under the “PSX” ticker symbol on the New York Stock Exchange.

Did you like Phillips 66’s Revenue by Product Category statistic?

Access more such key performance indicator (KPI) data points, on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.