PagerDuty’s Revenue Breakdown Worldwide (2019-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

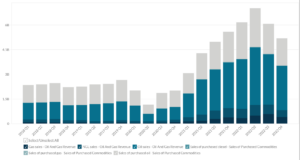

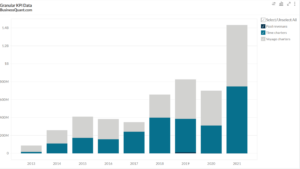

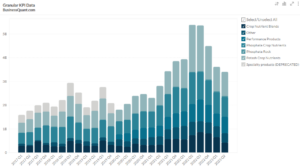

This statistic highlights PagerDuty’s Revenue Breakdown Worldwide, split between the United States and International, reported on a quarterly basis from Q1 2019 onwards.

The company has a customer base that is not only large but also globally extensive. They intend to further build and grow their sales outside North America. Their low friction nature and the self-service of their offering allows them to expand with ease and penetrate other geographic regions that promise significant opportunities. PagerDuty intends to grow its international market presence for accelerating existing customer expansion as well as new customer acquisition, especially throughout Europe, the Middle East, and Africa (EMEA), Asia Pacific, and Japan.

A part of PagerDuty’s growth strategy involves the further expansion of the company’s operations and international customer base. In the fiscal years ending January 31, 2021, 2020, and 2019, the company’s non-US customers contributed 24%, 22%, and 20% of the total revenue respectively. PagerDuty currently has offices in the United States, the United Kingdom, Canada, and Australia. They continue to develop and adapt to strategies that address and focus on international markets.

PagerDuty’s Revenue Breakdown Worldwide

| Region | Q3 2021 | Q2 2022 | Q3 2022 | Contribution in Q3 2022 |

| United States | $40.97 | $51.02 | $54.29 | 75.65% |

| International | $12.81 | $16.52 | $17.47 | 24.35% |

| Total | $53.77 | $67.54 | $71.76 | 100.00% |

(All figures are in millions, except percentages)

Total revenue was the highest in the latest quarter, standing at $71.76 million in Q3 2022. The revenue has grown consistently over the quarters. The year-on-year growth from Q3 2021 to Q3 2022 was 33%, thereby growing from $53.772 million to $71.76 million in the latest quarter of 2022. The quarter-on-quarter revenue growth from the second quarter of 2022 to the latest quarter of 2022 was 6%, marking a rise in revenue from Q2 2022’s revenue of $67.536 million to $71.76 million in Q3 2022.

PagerDuty has two main regions through which it earns revenue. The major contributor of revenue for the company is the United States, which contributes 75.65% to the total revenue in Q3 2022, amounting to $54.287 million. On the other hand, the International region, which consists of countries other than the United States, contribute 24.35% to the total revenue in Q3 2022, amounting to $17.473 million.

PagerDuty’s revenue can be further bifurcated into the following:

United States

The United States is the highest revenue-generating region. On average, this region contributes approximately 76% to the total revenue. Revenue grossed by the States gradually increased through the above-mentioned quarters. Revenue earned, therefore, peaked in the latest quarter, standing at $54.287 million. This region’s revenue in Q2 2022 was $51.019 million. It grew by 6.4% on a quarter-on-quarter basis, from Q2 2022 to Q3 2022. The revenue earned in Q3 2021 was $40.966 million, thus the year-on-year growth from the third quarter of 2021 to the latest quarter of 2022 was 33%.

International

PagerDuty’s international revenue is generated from regions like Europe, the Middle-East, Africa (EMEA), Japan, the United Kingdom (UK), Asia-Pacific (APAC), Australia, and Canada. The average revenue mix of international regions through the quarters has been around 24%. The revenue from this region advanced with the quarters. Revenue earned in Q3 2021 was $12.806 million. The revenue grew on a year-over-year basis by 36%, from Q3 2021 to Q3 2022. Revenue growth on a quarter-on-quarter basis, from Q2 2022 to Q3 2022 was just 6%, indicating that the revenue grew by 6% from $16.517 million in the second quarter of 2022 till the latest quarter to $17.473 million.

About PagerDuty

Founded in 2009 by Alex Solomon, Andrew Miklas, and Baskar Puvanathasan, and headquartered in San Fransisco, California, the company is a platform for digital operations management empowering the right action when seconds matter. Their platform comprises their auto-remediation software. It is the best way to manage urgent and mission-work work and keep digital services always on. It is situated at the center of the company’s digital ecosystem which ingests signals and uses machine learning and automation for preventing and automating real-time work, avoiding and predicting downtime. PagerDuty collects data from virtually any software-enabled device or system and combines it with human response data processing and correlating it for understanding digital opportunities and problems which need to be addressed in real-time. PagerDuty’s common stock is publicly listed on the New York Stock Exchange (NYSE) under the ticker symbol ‘PD’.

Did you like PagerDuty’s Revenue Breakdown Worldwide statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.