Nexstar Media’s Revenue by Segment (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

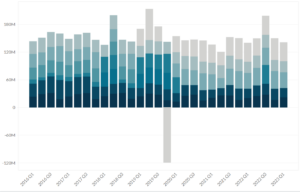

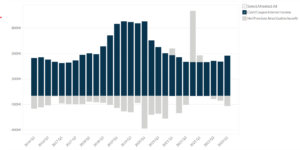

This statistic highlights Nexstar Media’s Revenue by Segment, split between Broadcast, and Other segments, reported on a quarterly basis.

Nexstar Media’s Revenue by Segment

| Revenue by Segment | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Broadcast | $1094.8 | $1108.3 | $1129.5 | 98% |

| Other | $23.4 | $23.3 | $27.5 | 2% |

| Total | $1118.2 | $1131.6 | $1157.0 | 100% |

(All figures are in millions, except percentages)

The performance of a company’s operating segments is calculated on the basis of the net revenue generated and operating income. A major part of Nexstar media’s revenue comes from its Broadcast segment, which accounts for 98% of the total revenue generated. Total revenue has not shown any noticeable growth in the last few years. It rose from $1131.6 million in Q2 2021 to $1157.0 million in Q3 2021, making an increment of 2.4%. on a quarter-on-quarter basis. It witnessed an increase of 3.46% on a yearly basis, as compared to $1131.6 million in Q2 2021.

Broadcast

The Company’s broadcast segment includes:

(i) Television stations and related community-focused websites that Nexstar owns, operates and programs in various markets across the United States. Most television stations are affiliated with networks and receive a big part of their programming, including prime-time hours, from networks.

(ii) News Nation, a live daily national newscast and general entertainment cable network. WGN America’s News Nation, their growing national newscast, competes with other established national newscasts such as CNN, FOX News, and MSNBC for viewers.

(iii) Two digital multicast networks, owned and operated by the company and other multicast network services. Although the commercial television broadcast industry historically has been dominated by the ABC, NBC, CBS, and FOX television networks, other newer television networks and growing popularity of subscription systems, became significant competitors for the over-the-air television audience.

(iv) WGN-AM, a Chicago radio station. Their target audience are people who prefer to engage over the radio. Specifically, stations they own or provide services to compete for audience share, programming, and advertising revenue with other television stations in their respective markets.

Revenue from the Broadcast segment has not shown any noticeable growth in the last few years. It has increased from Q3 2020 to Q2 2021 and then further grew from Q2 2021 to Q3 2021. On a year-on-year basis, the revenue increased by 3.16%, from $1094.8 million in Q3 2020 to $1129.5 million in Q3 2021. On a quarter-on-quarter basis, the revenue grew by 1.91%, as compared to $1108.3 million in Q2 2021. The Broadcast segment is the major contributor of the company’s total revenue in Q3 2021, accounting for about 98% of the total revenue.

Other

The other activities of the Company include corporate functions, the management of certain land assets, including revenues from leasing certain owned office and production facilities, and eliminations. The digital businesses’ include video and display advertising platforms that are delivered locally or nationally through their own and various third-party websites and mobile applications.

Revenue from the Other segment has not shown any noticeable growth in the last few years. It witnessed a drop from Q3 2020 to Q2 2021 and then increased from Q2 2021 to Q3 2021. On a year-on-year basis, the revenue grew by 17.52%, from $23.4 million in Q3 2020 to $27.5 million in Q3 2021. On a quarter-on-quarter basis, the revenue increased at the rate of 18.5%, as compared to $23.3 million in Q2 2021. This segment contributes 2% to the company’s total revenue inn Q3 2021.

About Nexstar Media

They are a television broadcasting and digital media company focused on the acquisition, development, and operation of television stations, interactive community websites, and digital media services. They own WGN America which is a national entertainment cable network. They are the house of the national newscast “News Nation”, various digital products, digital multicast network services and content. They have a 31.3% ownership stake in Television Food Network, G.P. (“TV Food Network”), and a portfolio of land assets.

As of 31 December, 2020, they owned, operated, programmed, or provided sales and other services to 198 full-power television stations, including those owned by VIEs, and one AM station in 116 markets in 39 states and therefore the District of Columbia.

The stations owned and operated by the company provide services and free programming to their markets’ television viewing audiences. Their programmes include ones by produced by affiliated networks, programs that the stations produce, and first-run and rerun syndicated programs that the stations acquire. Their cable network delivers a growing national newscast and quality television series and movies. The common stock of the company is publicly traded on the NASDAQ under the symbol “NXT” and is a component of the Russell 1000.

Did you like Nexstar Media’s Revenue by Segment statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.