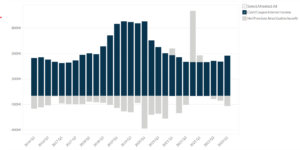

Mastercard’s Payments by Region (2016 – 2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

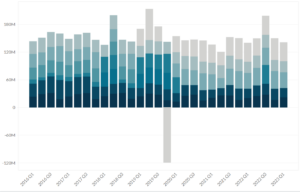

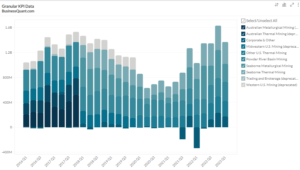

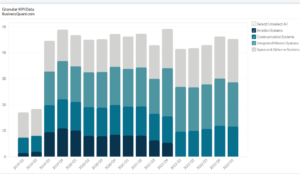

This statistic highlights Mastercard’s Payments by Region, split between APMEA, Canada, Europe, Latin America, and the United States, reported on a quarterly basis from Q1 2016 onwards.

Mastercard is a global payment technology business that connects customers, financial institutions, traders, governments, digital partners, enterprises, and other organizations, globally, so that they are not able to utilize cash or checks but rather electronic payment methods. A multi-rail network run by MasterCard provides users with a single point of contact for local and international payments. The primary operation of the company is to deal with the payments between banks or credit unions issued by consumers with the banks of businesses accepting pre-payment, credit, and debit cards of the “Mastercard” brand.

Mastercard’s Payments by Region

Mastercard’s Payments by Region were from the following regions:

- Asia-Pacific, Middle East, and Africa (APMEA)

- Canada

- Europe

- Latin America

- United States

| Region | Q1 2020 | Q1 2021 | Payments Share in Q1 2021 | YOY Growth |

| APMEA | $310.00 | $357.00 | 27.53% | 15.16% |

| Canada | $39.00 | $42.00 | 3.24% | 7.69% |

| Europe | $313.00 | $350.00 | 26.99% | 11.82% |

| Latin America | $70.00 | $69.00 | 5.32% | -1.43% |

| United States | $419.00 | $479.00 | 36.93% | 14.32% |

| Total | $1,151.00 | $1,297.00 | 100.00% | 12.68% |

(All figures in billions, excepts percentages)

Mastercard’s Payments by Region represents the total amount of payments made by a given region using credit and debit cards within a particular period. The company generates revenue by assessing consumers based on the gross dollar amount of activity on the goods that bear their brands, charging MasterCard customers fees for transaction switching, and offering other payment-related products and services.

Asia-Pacific, Middle East, and Africa (APMEA)

Mastercard’s payments grew 15.16% in APMEA from $310 billion in Q1 2020 to $357 billion in Q1 2021. 27.53% of total payments in 2020 were done in the Asia-Pacific, Middle East, and Africa.

Canada

Mastercard witnessed the lowest payments share of 3.24% in Q1 2021 from this region. Canada region showed a payment growth of 7.69% from $39 billion in Q1 2020 to $42 billion in Q1 2021.

Europe

Mastercard’s payments grew 11.82% in the Europe region from $313 billion in Q1 2020 to $350 billion in Q1 2021. This region contributed 26.99% of the payments share in 2020.

Latin America

There are 33 countries in the Latin America region which include Brazil, Mexico, Colombia, Argentina, Peru, Cuba, and many more.

Mastercard witnessed the negative growth of the payment of 1.43% on a year-on-year basis from the Latin America region. The payment declined from $70 billion in Q1 2020 to $69 billion in Q1 2021. In Q1 2021, this region contributed only 5.32 % of total payments.

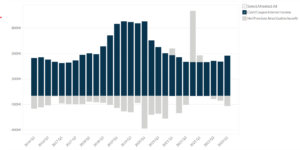

United States

The United States is constantly a major contributor to Mastercard’s payment share.

The United States contributed the highest payments share of 36.93% amounting to $479 billion in Q1 2021. Mastercard’s payments grew 14.32% in this region from $419 billion in Q1 2020 to $479 billion in Q1 2021.

Company Overview

Mastercard Incorporated is an American multinational financial services company. It was founded in 1966 as Interbank then in 1969 renamed as Master Charge, was subsequently styled as MasterCard from 1979. Its international headquarters is located in the purchase, New York, United States, and operations headquarters is in O’Fallon, Missouri. In 2002, the company merged with Europay International and became a private equity enterprise. This modification was done to prepare MasterCard for its initial public offer in 2006.

Mastercards has been facing strong competition from Visa, PayPal, Capital One, UnionPay International, and American Express. It has acquired 22 companies including IfOnly and Ekata. Before its IPO, Mastercard was a cooperative that controlled over 25,000 financial institutions that issued its branded cards. The company’s well-known brands, including Mastercard, Maestro, and Cirrus, make payments easier and more efficient by offering a wide range of payment solutions and services.

Did you like Mastercard’s Payments by Region statistic?

Access thousands of more such key performance indicator data points, on listed companies, with Business Quant.

You can also get started for free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.