Intel and AMD’s Market Share (x86 Desktop) (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

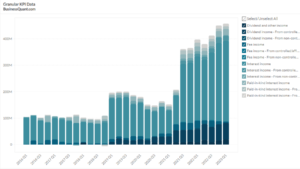

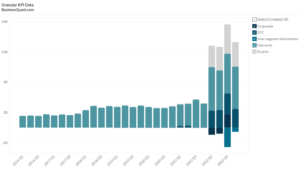

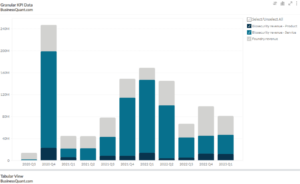

This statistic highlights Intel and AMD’s market share in the x86 desktop computing space, from 2016 onwards.

Intel and AMD Market Share (x86 Desktop)

| Companies | Q1 2021 | Q1 2020 | YoY Change (bps) |

| AMD | 19.30% | 18.60% | +70 basis points |

| Intel | 80.70% | 81.40% | -70 basis points |

x86

x86 is a group of computer architectures that was initially developed by Intel based on the 8086 microprocessor and its 8088 variant. Intel had many successors to Intel’s 8086 processor that ended in “86” like 80186, 80286, 80386, and 80486 processors thus the term “x86” was introduced. Over the years, additions have been made in the x86 class.

Many companies like IBM, SIM, NEC, AMD, VIA Technologies, Fujitsu, OKI, C&T, NecGen, Cyrix, Siemens, Intersil, UMC, and DM&P have designed and manufactured x86 processors (CPUs) for personal computers and embedded systems. Yet, only Intel and AMD are active producers. Therefore this article shows Intel and AMD x86 desktop’s market share.

Intel

Intel’s x86 desktop enables the user to stay productive, connected, and entertained. It enables the user to easily juggling applications at work, stream a favourite show, creating a blockbuster video, or playing a AAA game. Its desktop PCs offer strong performance, reliability, unmatched flexibility, and smart design features. Its design ranges from small mini PCs to sleek all-in-ones to ultra-performance workstations.

In Q1 2021, Intel had witnessed a shift to greater sales of lower-end desktop products. Core i7 was the best-selling Intel desktop which was driven by many people continuing to work from home as a result of the pandemic. In Q1 2021, Intel’s desktop market share was 80.70% which has decreased by 70 basis points year-over-year from 81.40% in Q1 2020. However, from Q4 2020 to Q1 2021, there has not been any change in Intel’s desktop market share.

AMD

AMD’s desktop applications include the AMD Ryzen series processors and AMD Athlon, processors. In 2020 AMD expanded the 3rd Gen AMD Ryzen desktop processor group by adding AMD Ryzen 3 3100 and AMD Ryzen 3 3300X processors that have “Zen 2” core architecture especially for business users, gamers, and creators. In July 2020, AMD introduced AMD Ryzen 4000 series and AMD Athlon 3000 series desktop processors with built-in Radeon graphics that provides power efficiency to gamers, creators, streamers, and other consumers. It also provides an added feature of multi-layered security. AMD’s biggest launch was AMD Ryzen 5000 Series desktop processor that was made in October 2020.

In Q1 2021, AMD’s Desktop market share was 19.30% which had increased by 70 basis points year-over-year from 18.60% of Q1 2020. However, since Q4 2020 there has not been any change in AMD’s desktop market share quarterly. In Q1 2021, AMD saw more demand for its high-end desktop PC models. The increase in AMD’s desktop’s market share was primarily driven by Ryzen 5000 processors which have out-shipped the previous-generation Ryzen 3000 CPUs by more than two times.

Company overview of Intel Corporation

Intel Corporation is an American-based company established in 1868 by Gordon Moore and Robert Noyce. Intel’s headquarter is in Santa Clara, California. Intel completed its initial public offering in 1981 and its common stocks are traded on Nasdaq Global Select Market under the trading symbol “INTC”.

Intel is known for creating life-changing technology for individuals as well as businesses. It manufactures microprocessors, integrated circuits, motherboard chipsets, network interface controllers, embedded processors, graphics chips, flash memory, and other devices related to communications and computing. Its microprocessors are used by the computer system manufacturers like HP, Dell, and Lenovo. Over the years Intel has acquired McAfee, Infineon’s Wireless Solutions, Fulcrum Microsystems Inc, Omek Interactive, Indisys, Movidius, Mobileye, and Nervana Systems.

Company overview of Advanced Micro Devices, Inc. (AMD)

Advanced Micro Devices, Inc. (AMD) is an American-based company that was established in May 1969 by Jerry Sanders. Its headquarter is in Santa Clara, California. AMD’s common stocks are listed on The NASDAQ Global Select Market under the trading symbol “AMD”.

AMD is a semiconductor company that produces computer processors and other similar technology for business and consumer markets. AMD’s prime offerings are server and embedded processors, discrete and integrated graphics processing units (GPUs), semi-custom System-on-Chip (SoC) products, graphics processors, workstations, development services, chipsets, data center, professional GPUs, motherboards, personal computers, technology for game consoles, x86 microprocessors, etc. Its customers are original equipment manufacturers (OEMs), large public cloud service providers, original design manufacturers (ODMs), and independent distributors in domestic as well as international markets.

Did you like Intel and AMD Market Share statistic?

Access thousands of more such key performance indicator data points, on listed companies, with Business Quant.

You can also get started for free.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.