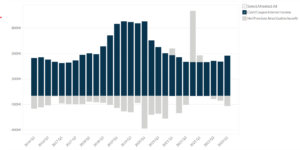

Fidelity National Financial’s Revenue by Segment (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

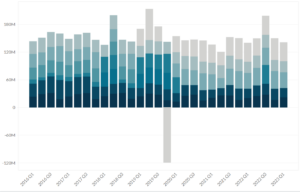

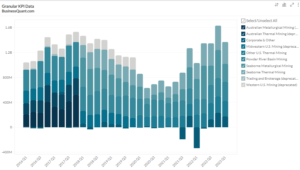

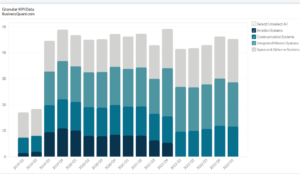

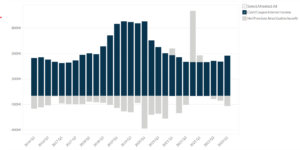

This statistic highlights Fidelity National Financial’s Revenue by Segment, split across Title, F&G, Black Knight, and Corporate and other, reported on a quarterly basis from Q1 2016 onwards.

Fidelity National Financial Inc., a Fortune 500 company, is a title insurance and settlement services supplier to the real estate and mortgage industry. The company is currently rated 288 in FORTUNE’s list of America’s Largest Corporations for 2021.

Fidelity National Financial’s Revenue by Segment

Fidelity National Financial Inc. generates a major part of its revenue from its title segment. In Q4 2021, 63.86% of its revenue was generated from the title segment, while only 35.26 % of the revenue was generated from the F&G segment. This is followed by the Corporate & other segment, with the least share of 0.88% in revenue in Q4 2021. The Black Knight segment generated no revenue and had a 0% share in revenue in Q4 2021.

Fidelity National Financial Inc’s revenue is bifurcated into the following segments:

| Revenue by Segment | Q4 2020 | Q3 2021 | Q4 2021 | Contribution in Q4 2021 |

| Title | $3.04 | $2.92 | $3.06 | 63.86% |

| F&G | $0.67 | $0.92 | $1.69 | 35.26% |

| Black Knight | $0 | $0 | $0 | 0% |

| Corporate & other | $0.06 | $0.04 | $0.04 | 0.88% |

| Total | $3.77 | $3.88 | $4.79 | 100% |

(All figures are in billions, except percentages)

Title

Fidelity National’s Title segment provides title insurance, underwriting, escrow, and closing services to residential, commercial, and industrial clients, lenders, developers, attorneys, real estate professionals, and consumers through its nationwide network of direct operations and agents.

Contributing majority of the revenue, this segment accounts for 63.86% of the total revenue generated in the Q4 2021. The company generated $3.06 billion from this segment in the latest quarter of Q4 2021. This segment’s revenue witnessed an increase from $3.04 billion in Q4 2020 to $3.06 billion in Q4 2021 on an annual basis. This indicates an incline of 0.65% on a year-on-year basis. On a quarterly basis, the revenue rose from $2.92 billion in Q3 2021 to $3.06 billion in Q4 2021, witnessing an incline of 4.79%.

F&G

F&G is a member of the Fidelity National Financial’s group of enterprises. F&G is dedicated to assisting Americans in making their dreams a reality. F&G, located in Des Moines, Iowa, is a leading provider of annuity and life insurance products.

This category had a good contribution of 35.26% in the total revenue earned in Q4 2021. In this quarter, the company generated $1.69 billion. F&G‘s share in revenue witnessed an increase from $0.67 billion in Q4 2020 to $1.69 billion in Q4 2021 on an annual basis. This indicates a tremendous triple-digit growth of around 152.23% on a year-on-year basis. On a quarterly basis, the revenue rose from $0.92 billion in Q3 2021 to $1.69 billion in Q4 2021, witnessing a huge incline of 83.69%.

Black Knight

In the past 6 years, this segment has contributed in only two quarters-Q1 and Q2 of the year 2016. No revenue is generated by this segment after Q2 2016. Thus, the contribution to revenue mix of Q4 2021 is nil.

Corporate & other

This segment contributes the least revenue, accounting for 0.88% of the total revenue in Q4 2021, amounting to $0.042 billion. Revenue generated by the Corporate & other segment witnessed a decline from $0.060 billion in Q4 2020 to $0.042 billion in Q4 2021 on an annual basis. This indicates a 30% decrease on a year-on-year basis. On a quarterly basis, revenue decreased from $0.044 billion in Q3 2021 to $0.042 billion in Q4 2021, witnessing a minor decline of 4.54%.

About Fidelity National Financial Inc

Fidelity National Financial Inc. is a leading provider of real estate and mortgage title insurance and transaction services. Fidelity National Title, Chicago Title, Commonwealth Land Title, Alamo Title, and National Title of New York are the nation’s largest title insurance underwriters, collectively issuing more title insurance policies than any other title company in the United States.

Aside from their principal product, they also provide title insurance, closing and escrow services, and other title-related services. They aid in the protection of both residential and commercial property owners’ rights against unforeseen legal and financial demands that may arise after closing. Coverage may differ by state or municipality but their national expertise can handle them. This knowledge enables them to assist lenders, builders, developers, attorneys, and real estate professionals in growing and succeeding. Annuity and life insurance products through their wholly-owned subsidiary, FGL Holdings, including delayed annuities such as fixed index annuities, fixed-rate annuities, and immediate annuities, as well as indexed universal life insurance, are also offered. Highly regarded organizations frequently identify FNF as an industry leader.

Did you like Fidelity National Financial’s Revenue by Segment statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount till April 30

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.