Delta Airlines’ Fuel and Other Costs (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

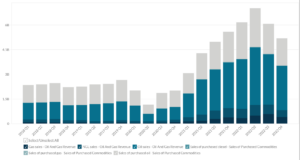

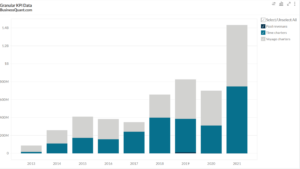

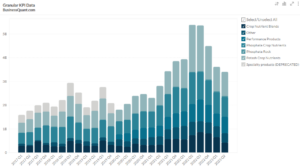

This statistic highlights Delta Airlines’ Fuel and Other Costs, reported on a quarterly basis from Q1 2016 onwards.

Delta Airlines provides passenger and cargo transportation in the United States and across the world. The company serves more than 300 locations throughout the world. It is considered as one of the largest airlines in the world.

The company’s business is divided into two segments – airlines and refinery. The airline segment forms the majority of the company’s revenue. The refinery segment is responsible for producing and supplying jet fuel for the airlines. The company’s revenue increased to $47 billion from $35.7 billion in 2018. Almost 90% of the total revenue is from passenger airlines.

Fuel costs for the company have been increasing over the years due to the increase in the price of oil and the increase in operations resulting in higher fuel consumption by the company. Fuel costs account for about 18-20% of the company’s costs currently. Back in 2016 fuel costs accounted for less than 15% of the company’s total expenditure. The fuel price per gallon had gone from around $1.5 per gallon in 2016 to $2.2 per gallon in 2018 and then started falling again and had reached around $1.96 per gallon in 2019.

In the first quarter and second quarter of 2016 fuel costs amounted to $1.23 billion and then increased to $1.42 billion in the third quarter and dropped down to $1.26 billion in the fourth quarter.

The fuel costs increased in 2017 to around $1.48 billion in the first quarter, $1.69 billion in the second quarter, $1.79 billion in the third quarter, and $1.80 billion in the fourth quarter. The cost shot up drastically in 2018. The fuel costs for the company went as high as $1.86 billion in the first quarter, $2.34 billion in the second quarter and reached $2.50 billion in the third quarter before a small drop to $2.33 billion in the fourth quarter.

Finally, in 2019, the rate of increase in fuel cost slowed down. The cost went up to $1.98 billion in the first quarter, $2.29 billion in the second quarter, $2.24 billion in the third quarter and then dropped to $2.01 billion in the fourth quarter.

The cost in every quarter was increasing when compared to the same quarter in the previous year from 2016 to 2018. 2019 saw this uptrend slow down and the costs in almost every quarter decreased when compared to the same quarter in 2018. The year on year costs also increased from $5.14 billion in 2016 to $6.76 in 2017 to $9.03 billion in 2018 and then dropped to $8.52 billion in 2019.

The costs are expected to fall drastically in 2020 as the coronavirus pandemic has halted the operations of flights. Even if flights were to be resumed they would be limited and most of the companies would rely on their fuel reserves rather than purchase more fuel to cut costs. As there will be little to no inflows during this time it will become difficult to sustain a business for airline companies and a few of them could face a solvency crisis. Due to the strong financials of Delta, the probability of then facing a crisis is low.

Did you like Delta Airlines’ Fuel and Other Costs statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.