Cleveland-Cliffs’ Revenue Breakdown by End-Market (2020-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

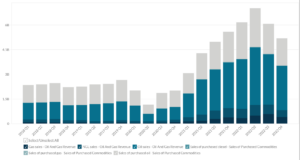

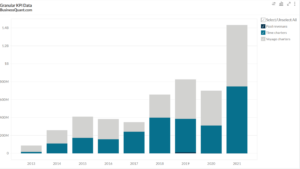

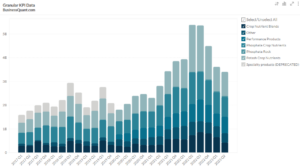

This statistic highlights Cleveland-Cliffs’ Revenue Breakdown by End-Market, split between Steelmaking and Other Businesses, reported on a quarterly basis from Q1 2020 onwards.

Cleveland-Cliffs’ Revenue Breakdown by End-Market

Cleveland Cliffs’ generates its revenue by selling its various steel and iron products. The company’s total revenue increased from $1.65 billion in Q3 2020 to $6.00 billion in Q3 2020, marking a growth of 265% on a year-on-year basis. It also increased from $5.05 billion in Q2 2021 to $6.00 billion in Q3 2021, marking a growth of 19% on a quarter-to-quarter basis.

Based on the End-Market, Cleveland Cliffs’ revenue is further bifurcated as:

| End-Market | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| Steelmaking | $1.51 | $4.92 | $5.87 | 97.75% |

| Other Business | $0.14 | $0.12 | $0.14 | 2.25% |

| Total | $1.65 | $5.05 | $6.00 | 100.00% |

(All figures in billions, except percentages)

Steelmaking

The Steelmaking market segment of Cleveland Cliffs consists of the revenue generated through their flat-rolled steel production which is supported by the largest iron ore pellet producer in North America. It primarily serves the Automotive, Infrastructure & Manufacturing, and distributors and converters markets. The product line for this segment includes Hot-rolled steel, Cold-rolled steel, Coated steel, Stainless steel, Electrical steel, and Plate steel among other steel and iron products.

A large part of Cleveland Cliffs’ total revenue is generated by the steelmaking market segment, accounting for as much as 97.75% in Q3 2021. It grew from $1.51 billion in Q3 2020 to $5.87 billion in Q3 2021, registering a growth of 290% on a year-on-year basis. It also increased from $4.92 billion in Q2 2021 to $5.87 billion in Q3 2021, marking a growth of 19% on a quarter-to-quarter basis.

Other Businesses

The other business market segment includes the revenue generated through operating segments which provide customer solutions through carbon and stainless steel tubing products, advanced engineering solutions, tool design & build, hot as well as cold-stamped steel components, and complex assemblies.

This market segment accounts for only a small percentage of Cleveland Cliffs’ Revenue, accounting for 2.25%. It fell marginally from $0.14 billion in Q3 2020 to $0.135 billion in Q3 2021, registering a decrease of 4% on a year-on-year basis. It increased from $0.12 billion in Q2 2021 to $0.14 billion in Q3 2021, marking a growth of 10% on a quarter-to-quarter basis.

About the Company

With humble beginnings as a mine operator in 1847, Cleveland Cliffs is the largest supplier of iron ore pellets and the largest flat-rolled steel producer in North America. The company is headquartered in Cleveland. With annual shipments of roughly 16 million tonnes, the company has an industry-leading automotive share. The company’s biggest advantage is the fact that it is fully integrated, implying that it produces the raw materials on its own and then uses these raw materials for steel production. From being the fifth largest flat-rolled steel producer in North America in 202o to becoming the largest, the company achieved great feats in a short span of time. Cleveland Cliffs successfully caters to the need for lightweight materials in new electric vehicle models. The company is traded on the New York Stock Exchange with the ticker name CLF and its stock is a part of the S&P 400 Index.

Did you like Cleveland-Cliffs’ Revenue Breakdown by End-Market statistic?

Access more such KPI data points and segment financials on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.