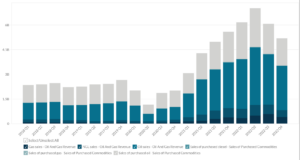

Biogen’s Revenue Breakdown by Product (2016-2023)

Exclusive Data

You need the Pro Plan to access KPI data

- Full access to the platform

- KPI data & segment financials on US stocks

- Financial data on thousands of stocks

- Download data in xlsx and csv formats

Pro Plan

$49 per month*

60% discount ends in:

.

About

More information

Subscribe to Pro or Enterprise plans to unlock this feature.

Contact the Analyst

Subscribe to Pro or Enterprise plans to unlock this feature.

Become a smarter investor today.

Access KPIs & Segment Financials on US stocks

This statistic highlights Biogen’s revenue breakdown by product, split across Multiple Sclerosis (MS), Spinal Muscular Atrophy, Alzheimer’s disease, Biosimilars and Others, reported on a quarterly basis from Q1 2016 onwards.

Biogen has been making medicines for the treatment of diseases like Multiple Sclerosis (MS), SMA, chronic lymphocytic leukemia (CLL), severe plaque psoriasis, non-Hodgkin’s lymphoma, follicular lymphoma, primary progressive MS (PPMS), relapsing MS (RMS), and other conditions. It has the research and development of more than two decades, for treating MS, resulting in a leading portfolio of MS treatments.

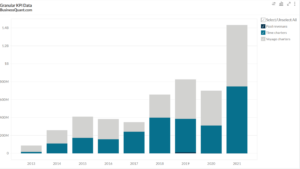

Biogen’s Revenue Breakdown by Product

| Product | Q3 2020 | Q2 2021 | Q3 2021 | Contribution in Q3 2021 |

| MS Product revenue | $1,984.90 | $1,529.20 | $1,556.00 | 70.54% |

| Spinal Muscular Atrophy | $494.40 | $499.70 | $444.10 | 20.13% |

| Alzheimer’s disease | – | $1.60 | $0.30 | 0.01% |

| Biosimilars | $207.90 | $202.40 | $202.80 | 9.19% |

| Other | $3.10 | $3.10 | $2.50 | 0.11% |

| Total | $,2690.30 | $2,236.00 | $2,205.70 | 100.00% |

(All the values are in millions, except percentages)

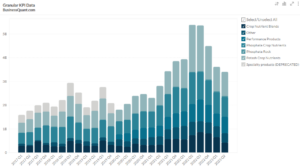

MS Product revenue

Biogen uses AVONEX, TECFIDERA, VUMERITY, PLEGRIDY, FAMPYRA, and TYSABRI for the treatment of Multiple Sclerosis (MS).

This product segment contributes 70.54% to the total revenue generated by all the products by Biogen in Q3 2021. It has generated a revenue of $1,556 million in Q3 2021, which is an increase of 1.75% on a quarter-on-quarter basis, from $1,529.20 million earned in Q2 2021. MS product segment shows a decline of 21.6% on a year-on-year basis, from $1,984.9 million in Q3 2020 to $1,556 million in Q3 2021.

Spinal Muscular Atrophy (SMA)

Biogen uses the product SPINRAZA for the treatment of Spinal Muscular Atrophy (SMA).

Revenue by products for SMA contributed 20.13% to the total revenue earned by the entire product mix in Q3 2021. SMA generated a revenue of $444.10 million in Q3 2021, showing a decline of 11.13% from $499.70 million on a quarter-on-quarter basis. This decline was equal to $55.60 million. This product segment shows a decline of 10.17% on a year-on-year basis, from $494.4 million in Q3 2020 to $444.1 million in Q3 2021.

Alzheimer’s disease

ADUHELM, a new product introduced for the treatment of Alzheimer’s disease was launched in Q2 2021, and therefore doesn’t have enough data to calculate the year-on-year growth.

The product for Alzheimer’s disease contributes 0.01% to the total revenue generated by the product mix in Q3 2021. Revenue generated from this product in Q3 2021 was $0.30 million, which is a decline of 81.25% on a quarter-on-quarter basis from the previous quarter, where the revenue stood at $1.60 million.

Biosimilar

Biogen has financial rights and certain businesses regarding RITUXAN, OCREVUS, RITUXAN HYCELA, and GAZYVA.

This product segment contributes 9.19% to the total revenue of the product mix in Q3 2021. It earned $202.80 million in Q3 2021, which is a rise of 0.20% on a quarter-on-quarter basis as compared to the revenue generated of $202.40 million in Q2 2021. The biosimilar segment shows a decline of 2.45% on a year-on-year basis, from $207.9 million in Q3 2020 to $202.8 million in Q3 2021.

Other

FUMADERM is the product termed as other products used for the treatment of severe plaque psoriasis, and other potential anti-CD20 therapies under the company’s collaboration arrangements.

Other sources of revenue contributes 0.11% to the total revenue generated by product mix by Biogen Inc. in Q3 2021. A revenue of $2.50 million was generated by this product segment in Q3 2021, which is a decline of 19.35% on a quarter-on-quarter basis, from $3.10 million in Q2 2021. This decline was equivalent to $0.60 million. The decline on a year-on-year basis for revenue from other products is the same as the decline on the quarter-on-quarter basis, amounting to 19.35%.

About the company

In 1978, Biogen was founded in Geneva as Biotechnology Geneva by several prominent biologists, Kenneth Murray, Phillip Allen Sharp, Walter Gilbert, and Heinz Schaller. This company’s core focus areas are MS/Neuro-immunology, Alzheimer’s Disease/Dementia, Neuro-muscular Disorders, Movement Disorders, Ophthalmology, Neuro-psychiatry, Immunology, Actual Neurology, and Neuropathic Pain. It is developing, discovering, and delivering for its core growth areas. Through commercialization activities and drug development, Biogen Inc. is reducing the cost burden for healthcare systems. The common stock of Biogen is publicly traded on the NASDAQ under the symbol “BIIB”.

Did you like Biogen’s revenue breakdown by product statistic?

Access more such key performance indicator (KPI) data points, on thousands of US stocks, with Business Quant.

You can get started here.

More data on US Stocks

Our Plans

Always know what you’ll pay. No hidden costs or surprises.

- Annual

- Monthly

60% discount until this Sunday

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our dashboards and dossiers.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Billed annually, local taxes extra.

60% discount on Annual plan

Pro

For serious investing

-

Company KPI data Access segment financials, non-GAAP metrics and KPI data from presentations and filings. Examples include financials by segment / region / product category, AT&T's broadband subscriber trends, Tesla's deliveries by model and lots more.

-

Stock research tools Features include : stock screener, stock comparison, industry financials, stock warnings, advanced charting tools, timeseries tables, scatter charts, financial statements, stock reports, SEC filings, stock ratings, institutional and insider ownership data. There are 200+ financial items and ratios on thousands of US stocks.

-

Industry data & tools Access premium operating data on 40+ industries. Examples include market share, smartphone shipments by vendor, subscribers by wireless carrier, historical gold production. There are 20,000+ such statistics.

Enterprise

For tailored workflows

-

All of Pro plan Get unfettered access to all our features.

-

Custom built features Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow.

-

Admin billing Back-end documentation support and multi-seat licensing.

* Local taxes extra.